The 10-Q is a multi-purpose tool. You can use it to break news, to get a better understanding of the companies you cover, or simply for reference, to fill in the gaps as you report and write. Once you get to know it, you’ll find yourself coming back to periodically, for a variety of reasons.

THE CORE OF THE 10-Q

After the financial statements, the Management Discussion & Analysis section tends to be one of the most-read parts of 10-Q filings.

This is where the company’s management walks investors through the financial results: Why did revenue fall and operating expense rise? What drove a decline in the effective tax rate?

If the financial statements, and the income statement in particular, summarize what happened in the quarter, the MD&A is the place to go to find out why and how it happened.

For example, here is part of FedEx’s summary of why net income fell in the third quarter of FedEx’s fiscal 2013, compared to the same quarter in 2012:

“Our results for the third quarter reflect a significant decline in profitability at FedEx Express resulting from ongoing shifts in demand from priority international services to economy international services and lower international export yields. … Our results were also negatively impacted by business realignment costs of $47 million in the third quarter of 2013 primarily related to our voluntary cash buyout program for eligible U.S. officers and managing directors … Additionally, operating result comparisons were negatively impacted by the reversal of a $66 million legal accrual in the third quarter of 2012.”

In other words, international customers are switching to cheaper services, the company paid $47 million to buy out departing officers and top employees, and, a year ago, the company’s results benefited because it didn’t have to pay as much in legal expenses as it had expected.

REMEMBER YOUR HISTORY

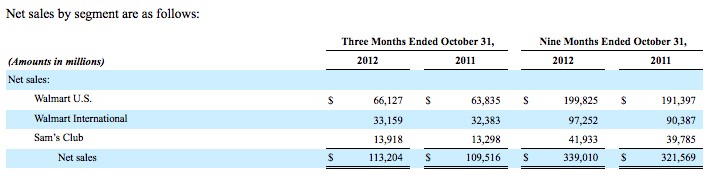

Compare & contrast: Wal-Mart Stores’ third-quarter 10-Q breaks down sales by company division, comparing both the most recent quarter and the most recent nine months to the same periods in the prior fiscal year.

Quarterly reports are, first and foremost, intended to update investors on new developments. As a result, most of the emphasis is on what happened in the just-ended quarter.

At the same time, the significance of what just happened often depends on what came before. So most 10-Qs offer comparisons to prior quarters, both in tables and in the text as a whole. Tables showing revenue or expenses, for example, will give figures for the most recent quarter and the same quarter a year earlier. This “year-over-year” comparison helps account for seasonal fluctuations — spiking toy sales around Christmas, for example.

Occasionally, though, tables or text will compare the most recent quarter to the immediately preceding quarter. That can be useful. Just make sure you differentiate between this kind of sequential comparison and the more common year-over-year comparison.

A third kind of comparison provides year-to-date figures. You won’t find this in 10-Qs covering the first quarter of a company’s year, but you are likely to in subsequent quarters. So the second-quarter 10-Q might list both the current quarter’s results, and results for the first half of the year; a third-quarter 10-Q would include cumulative figures for the first nine months of the year, in addition to the most recent quarter’s results.

Year-to-date figures can make it easier to see the big picture, but be careful that you don’t inadvertently confuse them with quarterly numbers.

GOING TO THE COURTHOUSE

Companies are required to tell investors about significant legal proceedings and update those disclosures each quarter. One section of most 10-Q filings addresses this, typically titled, “Legal proceedings,” or something similar.

It isn’t uncommon to see just a few lines here: a reference to the most recent annual report (10-K filing) or another quarterly report. That typically indicates that there has been no significant change since that time.

When there have been new developments, a few companies make it easy, disclosing only the new details. Sometimes that means you have to refer back to earlier quarterly reports (or the most recent annual report) to get the full picture, but at least you know what’s new.

Other companies simply reprint the entire legal proceedings disclosure, tweaking the phrasing or adding a few words or sentences as required. Be careful: Companies aren’t obliged to report developments chronologically, or make it easy to see changes. Spotting changes sometimes means looking at sections of two filings next to one another and comparing them line by line.

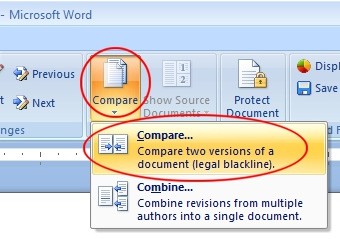

HOW TO COMPARE TEXT

A variety of paid services makes it easier to find specific words and phrases across multiple filings. All have different features, and some have given news organizations discounted access in the past, for publicity’s sake. Among the companies offering expanded filing services are Morningstar Document Research, AlphaSense and DisclosureNet.

SEC Infois a free service provided by Fran Finnegan & Co. It does many of the things that the paid services above will do, although the site’s interface can be less intuitive.

Another way to compare filings or parts of filings: Save the first filing from your browser and open it in Microsoft Word, or copy-and-paste text from a filing into a blank Word document. Do the same with the second filing. Then use Microsoft Word’s “Compare Documents” function to see what’s changed. (Microsoft Word alternatives, such as Libre Office and OpenOffice, often include a similar function, though of varying quality.) For shorter passages, also check out textdiff.com or other online text-comparison services.

RISKY BUSINESS

Every business faces risks, and companies are supposed to tell investors about any that are apparent.

The main home for these disclosures are in a section of a company’s annual report titled, “Risk factors.” But any changes since the annual report are supposed to be reflected in the 10-Q.

Just as with legal proceedings, companies update their risk factors in different ways. Some simply reprint their entire risk-factors disclosure every quarter; it’s up to you to figure out what’s changed (again, sometimes through painstaking line-by-line comparisons).

Other companies are friendlier, and include in their 10-Qs only new risk factors, or those that have changed. That sometimes means reprinting several paragraphs even though only a sentence or two has changed. Either way, check this section.

Much of what shows up here is boilerplate, the legal equivalent of a company covering its bases. Dozens of companies added generic warnings about earthquakes and tsunamis after the devastating events in Japan in 2011.

But changes are often worth looking into: Securities lawyers rarely add information for fun, and the changes could tell you something about problems the company is anticipating.

BE CONCERNED (very concerned)

One of the hot buttons for investors worried about a company’s future is the “going concern” clause. It should be a concern for employees, customers and others as well.

The clause is among the strongest warnings that a company’s auditor can issue and indicates that the company could face liquidation. It often notes “factors [that] create substantial doubt as to the Company’s ability to continue as a going concern” – or words similar to those, taken from the 10-Q that Iconic Brands filed on April 17, 2013. (Iconic Brands said the company hopes to “improve its financial condition by reorganizing and acquiring a new business.”)

Going concern clauses are unusual, but if you’re looking at a company thought to be on the brink, it’s worth taking a look. The clause can appear under the under a heading such as, “Basis of presentation,” within the company’s Summary of Significant Accounting Policies. Or just search for the phrase “going concern” and read carefully.

AFTER THE FACT

In the past, companies tended to include a section titled “Subsequent events,” disclosing developments of significance that occurred in the month-and-a-half or so between the end of the quarter and the 10-Q’s publication.

A few still do this; others might mention subsequent events throughout a quarterly report, in relevant sections. Keep your eye out for the term (or search for it) and for mentions of dates after the end of the quarter. They typically indicate the newest developments – ones that might not yet be on your audience’s radar screens.

JUDGE BY THE COVER

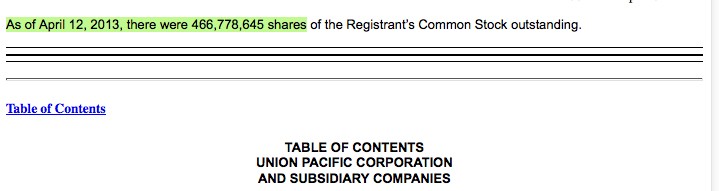

If you need a recent share count, check the company’s latest 10-Q or 10-K, usually near the bottom of the cover page or just before the table of contents.

Right on the cover page of the 10-Q – maybe the second screen in your browser – companies list the number of outstanding shares: 466.78 million for Union Pacific Corp. on April 12, 2013, or 10.78 billion for Bank of America on Oct. 31, 2012, for example.

Use that figure when you need to come up with a market-capitalization or per-share number on your own. If a company is being bought and the parties don’t immediately provide a per-share number for the purchase price, for example, you can estimate it: Divide the total purchase price by the number of shares.

GO TO THE SOURCE

You’ve already used 10-Q data if you’ve ever looked up a company’s net income or revenues on Google Finance, Yahoo! Finance, or on similar sites, including Nasdaq.com or Morningstar.com.

But if you want to be certain you’re using the numbers reported by the company, go straight to the source. The 10-Q includes the company’s financial statements, including the income statement and balance sheet, typically high up in the filing. Some companies list a condensed version first, then include the more complete version deeper in.

Either way, get familiar with how the companies you cover report their financials, since there can be some variation in how they present the numbers. If you can avoid it, you don’t want to be scrambling on deadline to figure out which line shows total revenues.

SEARCH AND YE SHALL FIND

Searching for “criminal” in Chipotle Mexican Grill’s 10-Q finds details of multiple federal employment-law inquiries. (The company says it believes its employment practices meet legal requirements.)

Quarterly reports can be long. And companies can describe the same development in multiple places, with varying degrees of detail.

So if you find an interesting paragraph, once you’ve finished reading it, search for some of its key terms or phrases.

You may just find more detail deeper in.

VIDEO TOUR

If you want to take a video tour from Theo Francis, watch as he walks you through a 10-Q from eBay Inc. If not, come back to the video – a link is on every page.

Walking through Ebay’s 10-Q filing with Theo Francis from Reynolds Center on Vimeo.