The 8-K’s strong suit for reporters is news. After all, companies use them to disclose (or try to bury) news of their own.

With the biggest companies, it’s hard to beat the wire services when it comes to juicy details that can move the markets. But you can at least keep up. (And if you work for one of the wire services, some of the tips below may help you beat the competition.)

Moreover, if you dig a little deeper, you can find stories others are overlooking, or details that can add life to your longer-term reporting.

Here are some suggestions to keep in mind while reading 8-K filings:

More than meets the eye

As newsworthy as they can be, corporate filings aren’t news stories, so don’t expect the most important details at the top. In fact, companies sometimes seem to take pains to bury the news, especially if it’s bad.

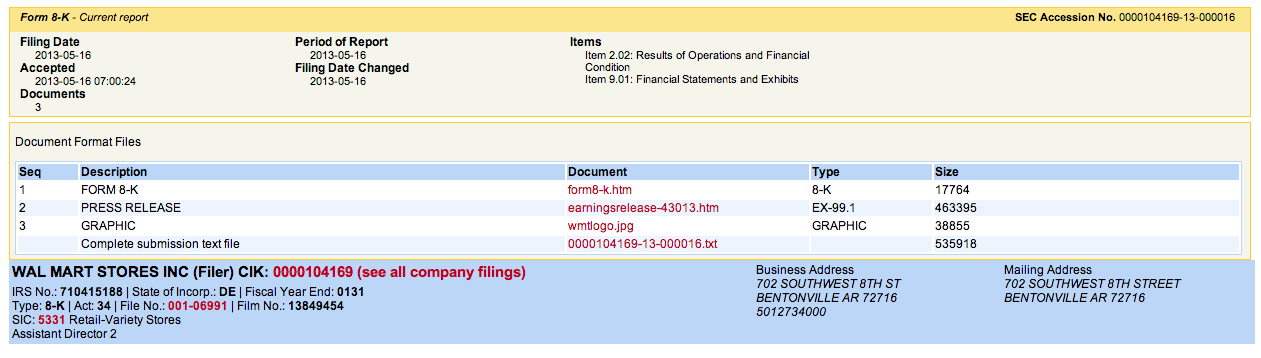

Start by skimming the filing, without necessarily reading it in full. Check the 8-K Filing Event code. In Edgar, when you click on through to a filing, you first get an index page (“Filing Detail”); note the exhibits – they’re numbered using the same general 8-Ks Item codes. Often, the exhibits are more detailed than the 8-K itself.

Once you open the actual filing – the first link from the index page in Edgar – most of the numbered items are broken out individually into separate paragraphs or sections. The text can be repetitive, but each item is rarely more than a few paragraphs. Sometimes the filing itself just refers readers to one or more of the exhibits (especially an earnings release or press release).

Double duty

But watch out. Multiple item numbers or sections in an 8-K might just reflect different disclosure requirements under different regulations for the same real-world event. But there’s no rule that says companies have to stick to one topic in an 8-K – some disclose details about multiple unrelated developments.

So a routine 8-K with an earnings release could include a separate section noting that the CFO or another senior executive is planning to retire at the end of the year. Or an unremarkable update to the company’s ethics policies could be followed by a section on a major plant shutdown.

Chris Roush, founding director of the Carolina Business News Initiative at UNC-Chapel Hill, has written about his all-time favorite 8-K, more than a decade old. He often refers to that March 2000 filing from Superior National Insurance.:

The company, according to this 8-K filed in March 2000, disclosed that it had been taken over by regulators, the top executives had been fired, NASDAQ had halted trading in the stock, that it had hired a bankruptcy attorney and the only way to reach the executive team was to leave a voice mail at a specific number.

Watch for amendments

As with proxies, 10-Qs and other kinds of filings, companies can amend 8-Ks long after they are originally filed. Appropriately, 8-K amendments are coded as 8-K/A filings in Edgar. It’s usually worth checking out at least briefly.

Sometimes the amendment can reflect a serious problem or error with the prior filing. Other times it means the company simply omitted information it was initially supposed to include, perhaps because it wasn’t yet available.

For example, a newly hired executive might not get an employment agreement immediately – in some cases, the contract isn’t signed for weeks or months, at which point a new 8-K or an amendment is usually filed. So if the initial filing doesn’t include all the details, keep an eye out.

Read carefully

Most 8-K filings are written by lawyers, or at least reviewed by lawyers. They aren’t just worried about following securities regulations – they also want to avoid lawsuits.

As a result, it can sometimes be tricky to decipher just what happened when, for example, an executive leaves the company. Was he fired or did he quit? Companies rarely say – and typically don’t have to – but you can find hints. For example, if the 8-K says the executive is receiving severance, or that his departure was a termination “without cause,” it usually means he was shown the door. (Termination “with cause” is even rarer to find – it generally means he was fired for wrongdoing; expect the lawsuits to fly.) Even if a departure is described as “voluntary” or a “retirement,” check the terms of any payments against the executive’s employment agreement: It may match the severance spelled out for involuntary termination.

Compare differences

Exhibits filed with 8-Ks can be lengthy, whether revised bylaws or stock-option plans, and often little changes from one version to the next, despite years in between. But even small changes can be significant.

Sometimes companies will mention where the previous version was filed; otherwise, check the Exhibit Index in the company’s annual report, or 10-K filing, which should list any prior version and say where to find it. To spot changes in phrasing, load both documents into Microsoft Word and use its “compare documents” feature. (Other word processors often have similar features.) For shorter passages, check out tools like TextDiff.com.

Counting votes

For decades, annual meetings were staid affairs, and the 8-Ks disclosing their results were rarely noteworthy. That’s changing, as activist shareholders and new regulations combine to make both more interesting.

But when a company issues an 8-K detailing the results of its annual meeting, look closely.

Most companies provide the bare minimum of information: Sparse tables showing the number of votes cast for or withheld from a director, or abstaining; as well as votes for, against or abstaining in Say on Pay and shareholder-proposed questions. The tables usually also include numbers for “broker non-votes,” which are essentially shares that don’t count as voted or abstaining.

Different kinds of questions have different standards for passing: Some require a majority of shares voted, meaning an abstention counts as “no” but non-votes don’t count. Other questions require a majority of shares eligible to vote, or even a super-majority of 60% or 80%. As a result, a shareholder question that receives a majority of votes cast may still not officially pass, and a director who receives a minority of votes may well keep his seat.

Still, it may be newsworthy that a majority of shareholders favor a change that management opposes, whether or not the measure technically succeeded. Similarly, if directors have a significant percentage of votes withheld or cast against them, it’s probably worth a story.

Watch out: Most of the time, the votes involve huge numbers – a big company might have billions of shares outstanding, so a dissenting vote of a few tens of millions of shares looks big but remains a drop in the bucket. Be sure to calculate the percentages yourself. (Only a few companies show percentages, and even then, sometimes they don’t add up.)

Note, too, that companies sometimes disclose annual meeting results in 10-Q filings instead. However, the contents is usually the same.