Our popular business beat basics series is now available all in one place in ebook form for your convenience. Go here to download the Reynolds Center’s free ebook, Business Beat Basics.

***

ANATOMY OF A 10-K

Part I

If you’re just getting to know a company, start at the beginning: Item I: Business.

Here, the company describes what it does (often with a smidgen of corporate history), and breaks its operations down into different business lines and markets, describes its competition and workforce, and touches on the significant labor or regulatory issues it faces.

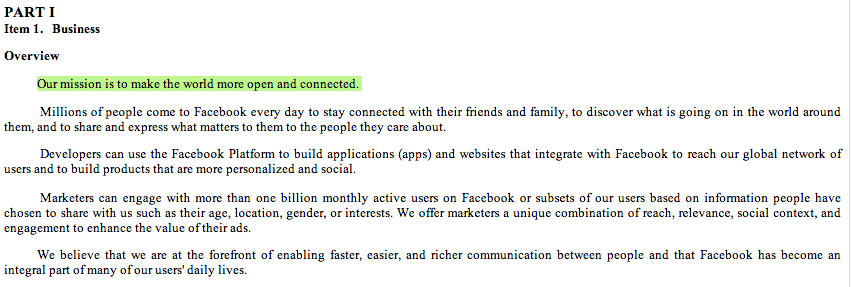

It’s tempting to skip over the long section that follows, Item IA: Risk Factors. Much of it is dry and dull, and new additions can be predictable. After the massive earthquake, tsunami and nuclear disaster in Japan in March 2011, for example, plenty of companies suddenly began disclosing the risks that earthquakes and nuclear accidents might pose.

Still, absent that kind of sweeping development, lawyers are a conservative bunch: They rarely change things without a reason. If you see a new risk factor in a company’s 10-K, or language changes significantly from one filing to the next – and especially if the reason isn’t apparent – it’s probably worth trying to find out what’s going on, either at the company or in the industry more generally. At the very least, you may have found a trend story.

A few sections in the 10-K that are important but rarely helpful. Item 1B: Unresolved Staff Comments is one. In theory, if a company is still bickering with the SEC staff over disclosures in a previous filing – typically because the agency wants the company to disclose more than management would like – it should show up here. In practice, before the 10-K is filed.

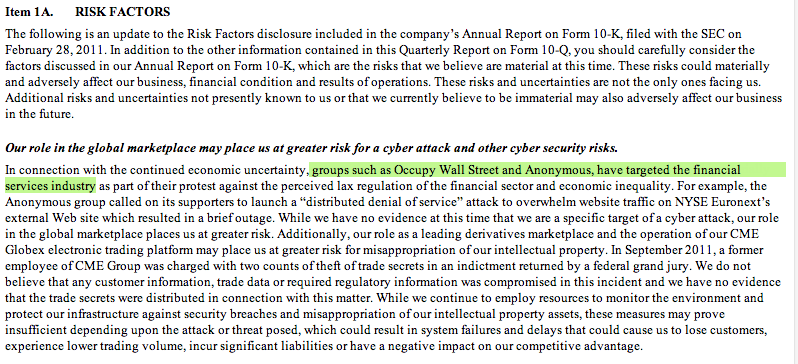

Item 2: Properties gives you a sense of how big and far-flung a company’s operations are, physically. Small companies list every facility they own or rent; others list the most significant ones, and big chains tend to list aggregate numbers by state or country, as appropriate. Either way, spotting changes here can be illuminating. In 2010, for example, footnoted.com’s Michelle Leder noticed that Home Depot said it had 10 stores in China – down from 12 the prior year, apparently signaling a retreat from bold expansion plans, at least temporarily.

Similarly, Item 3: Legal Proceedingsis supposed to be just what it sounds like: a rundown of all the litigation and regulatory proceedings that the company faces. Often, companies have already disclosed all but the most recent developments listed here. But that isn’t always the case, so look closely.

Companies are supposed to disclose the potential size of their legal liabilities in a couple of different ways. First, they should book a reserve for legal liabilities that are both likely and can be reasonably estimated. That leaves a lot of wiggle room, and corporate managers tend to assume they’ll win most or all the cases they fight, or claim they can’t possible estimate how big a hit a given lawsuit will inflict. Even when a company loses in court, and a judge or jury imposes multi-million-dollar penalties, companies sometimes fail to book a reserve, arguing that they expect to win on appeal. Apple Inc., for example, lost a $368-million jury verdict in a patent lawsuit last year, but the company hasn’t recorded a reserve for the case because it says it expects to win on appeal.

In addition, disclosure rules now require companies to disclose an estimate or range for reasonably possible losses from litigation, even if those losses aren’t considered “likely.” Not surprisingly, companies often declare such estimates are impossible, getting them off the hook. Occasionally, however, they do provide eye-opening numbers. Goldman Sachs, for example, said in its 10-K for 2012 that it was reasonably possible that the company could lose as much as $3.5 billion for those cases where the company can estimate potential losses.

The next part, Item 4 comes in two flavors. Companies that operate coal mines (or other mines covered by the Federal Mine Safety and Health Act of 1977) now must include new Mine Safety Disclosures, with details of health and safety violations, regulatory orders, citations, litigation and fatalities. Some companies point readers to a more detailed description in an exhibit. At the same time, plenty of SEC guidance says Item 4 covers the Submission of Matters to a Vote of Security Holders – aka annual meeting results — and some companies still use it for that purpose if they didn’t file an 8-K with the information soon after the meeting.

Part II

The second major chunk of the 10-K goes more deeply into the numbers and much of the arcana of a company’s operations and financial activity — but don’t let that scare you off.

Item 5: Market for Registrant’s Common Stock lays out basic data about the company’s shares, including high and low prices; often an average price; and details on dividends and stock repurchases. You can often get more current or easier-to-read data from Yahoo! Finance, Reuters, Morningstar or similar financial data sources. Still, if you need a snapshot for a particular time-period, this section can be handy.

Then you ease into the company’s financials, first with Item 6: Selected Financial Data. These aren’t the company’s complete financial statements, but rather a look at some of the most significant elements. Among other information, it typically shows five years of major line items like revenues, operating expenses, net income, etc. – more than the two or three years in the full financial statements (included in Item 8, below).

Next comes Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations — often called the MD&A for short, it’s management’s own progress report. Read it with the financial statements (see below).

For the most part, the MD&A will echo what management says in earnings releases, conference calls and presentations to analysts, if a little more candidly and with more detail.

Unfortunately, if the company is doing things right, it’s hard to compare this section directly to disclosures from prior quarters and years: It’s too free-form, and changes too much from filing to filing, as different market pressures and competitive factors bear on the company to greater and lesser degrees over time. Put another way, reality is messy, and the MD&A often reflects that. The best approach: Read it or skim it, looking for anything surprising, given what you know about the company. And, as always, watch for big changes in numbers from one quarter or year to the next.

If you’re trying to understand a company’s vulnerability to currency fluctuations, commodity prices or interest rate shifts, check out Part II, Item 7A: Quantitative and Qualitative Disclosures about Market Risk. Otherwise, dip into it when you have a reason to do so.

For most investors, the full financial statements, under Item 8: Financial Statements and Supplementary Data, are the heart of the 10-K. Just keep in mind that the annual financial statements in the 10-K are audited, meaning the company’s outside accounting firm has gone through them and (except in rare circumstances) found nothing untoward. That’s no guarantee that everything is above-board (see: Enron), but it serves as one line of defense for investors.

After the actual financial statements come the infamous “footnotes.” These aren’t the kind of footnotes you find in a college term paper, however. Some sprawl for pages, and they go into minute detail about the company’s taxes, pensions and retiree benefits, stock-based compensation, accounting methods, a breakdown of the business by segment and geography, and commitments and contingencies.

For the most part, these sections break out important information that isn’t immediately obvious from the financial statements themselves – how a particular tax figure was derived, for example. Get a feel for what’s here, so you know where to find it when you need it. If you need to dive deep into a company’s operations and finances, take your time going through the footnotes, and talk to experts on the various topics as you go. Otherwise, just keep in mind that there’s copious detail about many of the company’s activities in these dense paragraphs.

Items 9 and 9A are usually unremarkable, but they can be important. The first reports Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. Accountant changes can be a red flag, particularly when a decent-sized company switches from a big, well-known accounting firm to a small, lesser-known one. Actual disagreements are rare, but likely serious if a company can’t resolve them by the 10-K deadline.

The Controls and Procedures section details any problems with the way the company polices its own disclosures and financial reporting. Of course, by the time problems show up here, investors usually already know, thanks to earlier 8-K filings, accounting restatements or news reports.

This is also one place you might find the company’s Report of Independent Registered Public Accounting Firm, a kind of report-card from its outside auditor. (It could also accompany the financial statements, or appear in an exhibit, among other places.) If all’s well, the auditor reports an “unqualified” opinion, and says the company maintained “effective” controls over its internal controls and financial reporting. Anything else – especially language questioning whether the company is a “going concern” or providing a “qualified” opinion (or disclaiming any opinion) – is probably news.

Item 9B, Other Information is one of the last substantive sections of most 10-K filings. As its name suggests, it’s a catch-all, and some companies use it to report “subsequent events” – developments that occurred after the end of the fiscal year, but before the 10-K is issued. It should also include any significant developments that would ordinarily have been reported in an 8-K or another filing, but are being wrapped into the 10-K for reasons of timing.

Parts III & IV

Most companies don’t include much in the third section of the 10-K. That’s because it’s designated for material that usually goes into the annual proxy filing, if companies file that document within a set timeframe. Most do.

Still, if you can’t find a company’s annual proxy, check here for information about directors and top executives, including compensation, stock holdings, and potential conflicts of interest.

Part IV’s only section, Item 14: Exhibits, is also straightforward: It includes any number of additional documents filed along with the 10-K. We’ll explore those more in the Tips section of this guide.