Like all corporate filings, the 10-Q tends to present company information in the best light possible (though there’s plenty of bad news that companies can’t get away with skipping). Unlike the proxy, however, spin is often less of a problem with 10-Q filings than sheer length and the density of the language that companies use.

DON’T BE INTIMIDATED

Below are some suggestions – both general and specific – for tackling a filing that can be daunting at first glance (and sometimes at second and third as well).

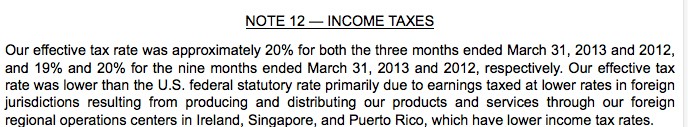

Jargon and legalese can make for dense reading, as shown by this excerpt from a recent Microsoft 10-Q. Don’t give up — break complex sections down to identify unfamiliar concepts and terms.

Corporate filings are supposed to be written for investors – average investors at that. In reality, they’re written by accountants and lawyers, for other lawyers – primarily the ones at the SEC, but also the ones who might be thinking about suing over the latest stock decline.

The result: a mess of jargon, boilerplate and just-in-case, CYA disclosures that can scare off all but the most intrepid reporter.

Become that intrepid reporter. Wade into the legalese and start taking it apart.

A printer, a highlighter and a pencil make good tools – tackle the section you’re focusing on sentence by sentence; distill the meaning of each into plain English, or even just a rough outline that makes sense to you. If the dates are jumbled – companies seem to love presenting developments out of order, especially unpleasant ones – consider a simple timeline. If the text mentions another filing, make a note to check it out later. If you run into a bunch of numbers, don’t be afraid to do the math.

Most of what’s in a 10-Q is decipherable by a reasonably smart person with a good command of English – and a bit of a stubborn streak. But if the language gets too technical and the concepts too unfamiliar, ask for help. Seek out an expert in the company’s field, or check the Resources section for more general assistance.

SKIM, SEARCH AND READ

Most reporters open up a 10-Q for one of three reasons:

- They’re looking for news.

- They’re looking for something specific, or

- They’re trying to get a better understanding of a particular company in general.

The different goals recommend different approaches.

SKIM FOR NEWS

If the 10-Q just came out and your goal is to spot any news that’s in there, skim. Understand in advance how the company organizes its quarterly reports, and zero in on the most significant sections. (See Tips and Tricks for suggestions.)

Also take a look at sections relevant to any ongoing stories. That means the legal proceedings for a company facing lawsuits, or the Mine Safety Disclosure for a natural-resources company that’s struggling with workplace deaths.

SEARCH OUT SPECIFICS

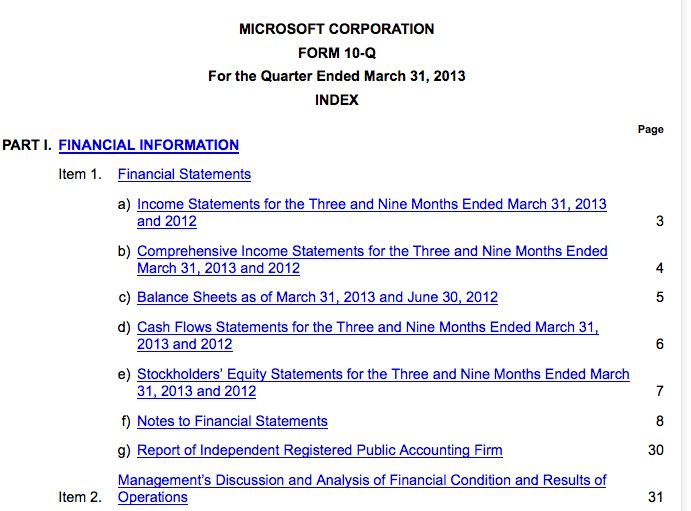

Some companies, including Microsoft, include tables of contents that link to key sections. Others don’t.

If you’re looking for something specific, control-F is your friend (or command-F on a Mac). A 10-Q is mostly one long document (though see below).

Many companies include a helpful table of contents near the top of the document, often with links to specific sections, which can also help home in on the information you need.

TAKE YOUR TIME READING

Finally, if you really just want to get to know a company better, don’t rush. Read through sections of the 10-Q over time, taking a break to do something else in between, so your eyes don’t glaze over.

Ideally, you’ll want to read the 10-Q with the most recent previous 10-Q or 10-K on hand, so you can see how things have changed.

PAY ATTENTION TO AMENDMENTS

Occasionally, companies file an amendment to a 10-Q, or re-file one entirely; both appear in the SEC’s Edgar database as a 10-Q/A filing.

Be sure to take a look at these. Sometimes they simply correct typographical errors or jump through bureaucratic hoops that were missed the first time around. But they can also indicate serious problems at a company: misstated financials, significant errors or major revisions.

Often, the 10-Q/A will include an “explanatory note” or “reason for amendment” at the beginning, outlining why the additional filing was made. For example, pizza chain Papa John’s International Inc. included this note in the 10-Q/A it filed April 16, 2013, it amended its 10-Q for the quarter ended Sept. 23, 2012, because it had botched the accounting for a joint-venture. This is how Papa John’s put it:

“The Company determined an error occurred in the accounting for one joint venture agreement, which contained a mandatorily redeemable feature added through a contract amendment in the third quarter of 2009. This provision contained in the 2009 contract amendment was not previously considered in determining the classification and measurement of the noncontrolling interest. In addition, the Company determined that an additional redeemable noncontrolling interest was incorrectly classified in shareholders’ equity and should be classified as temporary equity.”

ERRORS BIG AND SMALL

Companies sometimes make mistakes. When they do, they might file an amendment (see above). One of the most dramatic kinds of amendments is filed to restate the company’s financial results.

That usually means there were significant accounting errors, and it’s a good idea to understand why. That said, be sure to check whether the company had already warned investors that a restatement was coming. If so, the restatement itself may not be news, but the specifics may still be – for example, if the errors proved bigger than previously reported, or if the company’s explanation gives more insight into what went wrong.

Not all accounting errors lead to restatements. In some circumstances, companies can simply adjust results going forward. Then you probably won’t see a 10-Q/A. Instead, there will be one or more lines in the company’s financial statements reflecting the changes.

DON’T ASSUME ALL EARNINGS ARE EQUAL

Many companies put out their earnings reports – typically a press release and then an 8-K filing – as much as several days or a few weeks before they file their 10-Qs.

The earnings release typically is written to present the highlights of the quarter: the bottom line, of course, but also general selling and administrative trends during the quarter. But it’s also very much a public relations tool: Companies rarely lie, but they do often present their results in the best light possible.

By the time the 10-Q comes out, most reporters and many investors have moved on, figuring the headlines were in the earnings report.

That may be, but companies have much more leeway to spin the news in earnings releases. Often, the bad news gets buried in the 10-Q. Mostly, this takes the form of omission – some development not mentioned in the earlier press release appears in the quarterly report.

As a result, it can be helpful to refresh your memory when the 10-Q does come out by looking back at the earnings release before looking for discrepancies.

CHANGED OR JUST MOVED?

If it looks like the company has stopped disclosing some relevant piece of information – sales or operating profit figures for specific business segments, for example – poke around some more. Companies are creatures of habit, but sometimes they do reorganize the structure of their filings. Before concluding that the company is hiding something, make sure it hasn’t just been moved elsewhere in the document.

Sometimes you’ll open a 10-Q and discover that one of the more or less mandatory sections is missing altogether. Don’t panic.

Chances are good that the company has filed excerpts from a separate quarterly report as an exhibit to the filing, and the information is in there. This is less common with 10-Qs than 10-Ks, but it does happen sometimes. Look to see if there’s an exhibit numbered with a 13 – e.g., Exhibit 13.1 – before lobbing a suspicious call in to the media relations office. [Thirteen is the exhibit number reserved by the SEC for excerpts from 10-Qs and 10-Ks; here’s a complete list of exhibit numbers (PDF).]

DISCLOSURES DON’T ALWAYS DISCLOSE

There’s a wide variation in the level of detail that companies include in a 10-Q. Some treat the filing as a mini 10-K (the equivalent annual filing), others as very much an interim document, meant to do more than update numbers and a few other required details.

This is especially true in the Management Discussion & Analysis section. Some are detailed and explanatory – or even wordy. In its 10-Q from March 25, 2013, for example, drugstore chain Walgreen Co. starts out with a leisurely description of its business:

“Walgreens is principally a retail drugstore chain that sells prescription and non-prescription drugs and general merchandise. General merchandise includes, among other things, household items, convenience and fresh foods, personal care, beauty care, photofinishing and candy. Customers can have prescriptions filled in retail pharmacies as well as through the mail, and customers may also place orders by telephone and online.”

Other companies are much more laconic in their 10-Qs, sometimes to the point of ambiguity. This is the sentence Honeywell International included in the 10-Q it filed on April 19, 2013, to explain why administrative expenses didn’t rise, despite acquisitions and pay raises:

“Selling, general and administrative expenses as a percentage of sales was flat in the quarter ended March 31, 2013 compared to the quarter ended March 31, 2012 driven by disciplined cost management offset by merit increases and acquisitions.”

Translation: Management kept costs down by keeping costs down.