As mentioned in the Introduction, 8-K filings come in a bewildering variety. Below, we’ve identified some of the most common types that are the most useful to reporters.

The 8-K code

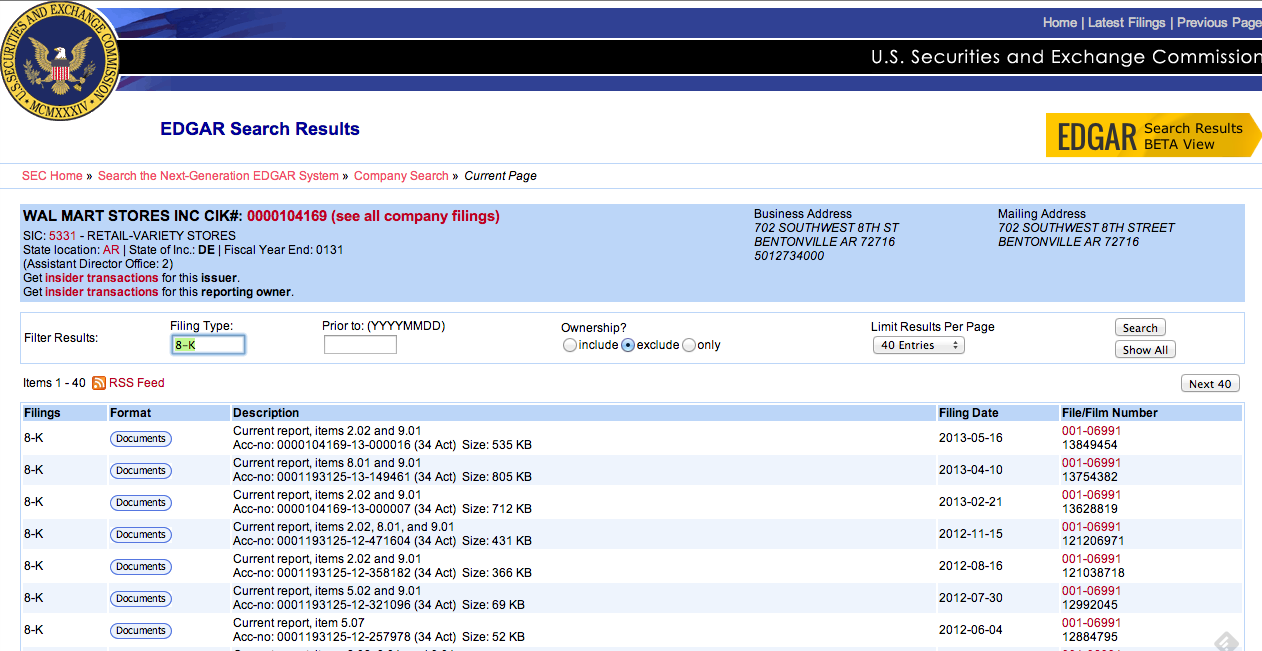

One often-overlooked feature of the 8-K is the number that designates which 8-K “item” is being reported by a particular filing. These numeric codes appear in the Edgar filing database’s list of results. They also often appear in the alert emails or results lists for third-party filings services, and some such services also let you use the categories to narrow your searches; that lets you zero in on, say, director departures and related events.

The codes are useful if you know what to look for, so we’ve included the code, or “item,” numbers of the 8-K categories below, in brackets with the heading. Still, as useful as the codes can be, when a new 8-K comes in, it is often just as fast to open it and skim the contents.Often even a single development can trigger disclosure under multiple items.

What’s in an 8-K

Significant contracts, new or terminated [Items 1.01 & 1.02]:Technically, a company must file an 8-K any time it enters into a “material definitive agreement.” But there’s some wiggle-room here. For example, agreements made in the course of routine business needn’t be disclosed, with a few exceptions. Often, the company need only file a description of the agreement, rather than the document itself, with the 8-K – but then the document oftentimes must be included in a subsequent 10-Q or 10-K filing.

Finally, companies may seek a confidential treatment order from the SEC, allowing them to redact (or black out) key elements of a contract, usually for competitive reasons. At the same time, this category does include unwritten (oral) agreements, which must be described, and any agreement to compensate senior executives (since the regulations consider those material by definition). Even when disclosed, material agreements won’t always be coded under Item 1.01, thanks to a provision that lets companies skip the designation as long as they include the same information under a different item number.

Bankruptcy or receivership [Item 1.03]: This is pretty self-explanatory. If you see an 8-K listing information under Item 1.03 for a company not already in bankruptcy proceedings, pay attention.

Significant acquisitions or dispositions [Item 2.01]:This usually reflects the final stage of a merger, sale or lease, of a significant part of the company. One widely cited threshold is about 10% of the company’s total assets, but there are other ways a deal can qualify as significant. Internal transactions aren’t included. And generally, you’ll hear about major agreements to make these sales or acquisitions well before the deal is finalized.

Quarterly earnings, monthly sales, etc. [Item 2.02]: This includes earnings reports, but related disclosures, such as a retailer or auto company’s monthly sales results. The 8-K itself often contains little detail, but refers readers to an accompanying press release, and sometimes a document with supplemental financial information. These disclosures generally come out with, or even after, the company’s press release on the subject.

Restructurings and write-offs [Item 2.05]: These 8-Ks can include announcements of big layoffs or the dollar amounts associated with a restructuring.

Delisting [Item 3.01]:The company is about to leave one of the exchanges or electronic markets on which its stock is traded – either voluntarily or otherwise. Any reprimand from the exchange must be included or summarized, and the filing is required even if there’s a grace period to fix any problems identified by the company or the exchange. Note that an 8-K typically isn’t required in connection with listings on such over-the-counter exchanges as the Over-the-Counter Bulletin Board (operated by FINRA), or on the Pink Sheets.

Unregistered stock sales [Item 3.02]: These 8-Ks are triggered by the sale of 1% (or for smaller companies, 5%) of the company’s shares in a private transaction. It can be a signal that a big outside investor is buying a significant stake in the company – perhaps a white knight for a company in trouble. At the height of the financial crisis, for example, Warren Buffett’s Berkshire Hathaway invested $5 billion in Goldman Sachs, leading to this 8-K filing and press release. Other times, a sudden private placement can indicate a deal struck with an activist investor.

Poison pills, etc. [Item 3.03]: This item is triggered if a company reduces the rights of its shareholders (or debtholders). One common way companies do this is through a so-called poison pill measure, designed to make hostile takeovers more difficult. Note that simply adopting a “shareholder rights plan” (aka, poison pill) generally triggers Item 1.01, not this item.

Change of accountant [Item 4.01]: This can be a big red flag. Companies sometimes change audit firms to save money – and sometimes to hire a more pliant accountant. Read carefully to determine if the auditor resigned, declined to stand for reappointment by shareholders, or was dismissed by the company. Once the replacement is announced – it might be in the same 8-K, or in a subsequent one – note whether the company went from a big brand-name firm to one few investors have heard of. Technically, an 8-K filed under this item is required to disclose any adverse audit opinion from the audit firm during the last two years, as well as any ongoing disagreement with the auditors. The filing also generally includes a letter from the accounting firm to the same effect.

But be careful: Just because both sides say there’s no disagreement doesn’t mean it’s so; the term has a specialized meaning here. Moreover, auditors and clients have ways of dancing around an issue without formally disagreeing, just to avoid telling the world. Note also that this is one of the few 8-Ks that must be filed even if the triggering event (an auditor’s dismissal) happens within four days of filing a 10-K or 10-Q.

Restatements and flawed financials [Item 4.02]: This kind of 8-K is triggered when past financial statements are so flawed that investors should no longer rely on them. That’s serious. Read carefully for whether the company or its auditor identified the problem, the description of the problem, and whether the problem affects one quarter or many years. Sometimes a company files multiple 8-Ks over several months before the full extent of the problem becomes public.

Change in control [Item 5.01]: The company has been bought or taken over. There’s usually some warning before one of these is filed, whether it is triggered by a hostile takeover, planned merger, or an investor buying up just over 50% of the company’s shares. Still, there may be some interesting detail.

Departure or appointment of top officers or directors [Item 5.02]: These 8-Ks are a big source of news. You’ll see one when a member of the corporate board, the CEO, chief financial officer, chief operating officer, or another high-level executive either is appointed or departs the position. It is filed only once the appointment or arrival is definite, so you won’t get a heads-up about impending changes. But the 8-K often includes details that aren’t in the company’s press release, so it’s worth taking a look. Officially, this 8-K covers only directors and “principal officers” (CEO, CFO, COO, chief accounting officer, etc.), whether temporary or permanent, as well as named executive officers, but some companies file them for other executives as well. Read the 8-K and accompanying material carefully to see whether the individual is retiring, resigning or being let go; it isn’t always easy to tell, and for executives, no reason is required, but sometimes there are clues.

Departing directors get a chance to sound off. They rarely do, but if one writes a letter expressing disagreement with fellow directors or dissatisfaction with the company, it must be included in the 8-K. Companies sometimes respond, and, very rarely, there’s a heated back-and-forth, which always makes for entertaining reading. But keep in mind that, when a company says there were no disagreements, it doesn’t necessarily mean what you’d expect. Yahoo! co-founder Jerry Yang quit the company’s board in 2012 after widely reported spats with management; yet, as footnoted.com reported at the time, the company was could still say he left “to pursue other interests, and not due to any disagreement with the Company on any matter related to the Company’s operations, policies or practices.” New appointments, whether for directors or executives, generally include a brief professional bio, and a paragraph or more on the individual’s compensation.

Note that companies can hold off filing an 8-K disclosing executive appointments until making a public announcement, but that’s not the case for departures. Moreover, the four-day clock to disclose starts once a director or officer gives (or gets) notice, not as of the actual date of departure. Only definite departures count, though – negotiations don’t, and neither does a director tendering his or her resignation only to have it rejected (e.g., after a director loses re-election at the annual meeting).

Compensation of top officers [5.02]: New or modified pay details for top executives are filed with the same code as the appointment or departure of directors and officers. Here, companies have some leeway in describing the new or changed pay, but they can choose whether to include the actual employment agreement or other contract. (If they don’t include it with the 8-K, they must do so with the 10-Q or 10-K covering the quarter in which it was signed.) Some companies report changes to director compensation arrangements in an 8-K as well, though it isn’t always required. (In that case, check the next proxy, or the 8-K filed the next time a new director is named.) Companies also don’t have to file a compensation 8-K when if an executive’s employment agreement renews automatically, but terminating his agreement would trigger a filing. Note that broad-based compensation plans – e.g., a 401(k) or health-care plan – don’t have to be disclosed just because an executive also benefits.

Changes to bylaws or articles of incorporation [Item 5.03]: These 8-Ks can be deadly dull, with jargon-laced text and massive exhibits. But they can also be important, if a company is disclosing changes that make it easier to acquire the company (un-staggering board elections, for example, or allowing a majority of shareholders to act by petition) or harder to do so (poison pills, staggering board elections, etc.). An 8-K is also filed under Item 5.03 if a company changes its fiscal year, which can make it tougher for investors to compare one year’s financial resuts to another’s.

Changes to ethics and related policies [Item 5.05]: Rarely signaling a major development, these 8-Ks can nonetheless make for an amusing story. For example, in late October 2010, Apple quietly cut “community” from the Principles of Business Conduct it listed in its revised Business Conduct Policy. Note, too, that companies are supposed to file an 8-K under this item when granting a top executive a waiver from the company’s ethics code; however, such filings appear to be extremely rare. Moreover, companies are allowed to notify investors of changes on corporate websites instead, in at least some circumstances.

Results of a shareholder vote [Item 5.07]: Most commonly filed after an annual meeting, these 8-Ks tell you just how well or badly the company fared. Typically, companies will announce preliminary results at the meeting, but that isn’t always the case – and if you can’t make the meeting, you may have to wait for the 8-K anyway.

Regulation FD [Item 7.01] and Other [Item 8.01]: These are the catchall 8-Ks filings. Regulation FD (for “fair disclosure”) prohibits companies from disclosing significant details to select investors. Reg FD 8-Ks generally disclose some piece of previously undisclosed information that was inadvertently shared with a smaller group of investors, perhaps at an analyst’s conference. The Other category is used for any manner of press releases, announcements and other developments.

Financial statements and exhibits [Item 9.01]: This code is usually used in conjunction with others, such as Item 2.01 (acquisition and disposition of assets), to include reworked financial statements reflecting the impact of the acquisition or sale.