Bonds gets no respect. It’s not clear why. For many companies, institutions and investors, bonds are the vehicle of choice.

Companies generally issue stock to the public to raise money. In issuing stock, companies give up ownership of the firm to shareholders, who share in future profits and growth. They also share in the risk if company should fail, or at least not live up to expectations. Not every investor is comfortable with that prospect.

Risk-averse investors want more of a sure thing. Stuffing cash into your mattress avoids the risk of company failure. But there are other risks, theft being the obvious one. A nice, government-insured certificate of deposit at your local bank sounds good. But as of this writing interest rates on CDs are so low buying them doesn’t seem worth the effort.

Fixed income investments

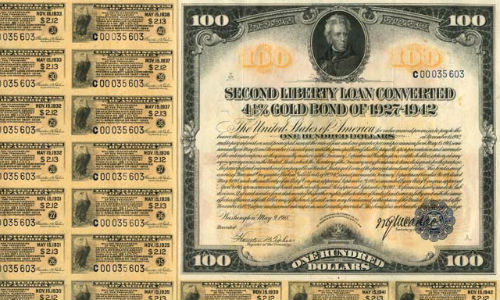

Both CDs and bonds are like loans and are called fixed income investments. Where CDs are generally issued by banks, bonds are issued by companies, governments and many quasi-governmental institutions. While a government-insured CD has virtually no risk of default, bonds carry a default risk correlated with the likelihood that the issuer will be able to pay the interest and return the principal.

The United States Government is constantly issuing debt securities to finance spending. The term “bond” is generally used for a loan lasting more than ten years. “Notes” are issued for one to ten years and bills are short-term loans lasting less than one year. Short-term U.S. government obligations are often called treasury bills or “T-Bills”.

The United States is considered the world’s best borrower. It has never defaulted on its debt. That helps make the U.S. dollar the world’s favorite reserve currency and allows the United States to borrow at the lowest cost. Treasury instruments are usually called “risk-free” investments. The 10-year treasury note is the benchmark most often used for comparison with other investments. If you can’t beat the return you get from putting your money into a 10-year treasury, why would you buy something with more risk?

The U.S. Treasury auctions 10-year notes almost every month. You can buy them directly by setting up an account at Treasury Direct or through your bank or broker. Individuals usually make “non-competitive” bids, meaning they take the interest rate arrived at through an auction process in which large investors specify the minimum interest rate they will accept. For example, you might buy a $10,000 10-year note paying $300 in interest each year. That gives you a steady stream of income, which explains the term “fixed income” investment. $10,000 is the principal or face value, 3 percent the interest rate or “coupon,” and 10-years the term.

The greater the risk….

State and local governments and local institutions, such as school districts and transportation authorities, are authorized to issue bonds in order to raise money. Private companies also raise capital by issuing debt. In considering which to invest in, investors consider the previously mentioned risk of default. Bond-rating agencies like Standard & Poor’s and Moody’s provide estimates of the risk for fixed income securities. But the bond issuer usually pays the ratings agency for this service, which has raised concerns over conflicts of interest. In case of default a bond holder is generally at the head of the line when it comes to being a creditor in bankruptcy court. Stock holders are at the end. Bond holders often get smaller payments than originally expected, say 50 cents on the dollar, but they get something. This is known by the poetic term “taking a haircut”.

The riskier the investment, the more the borrower must offer as an incentive. This is reflected in the interest rate the borrower offers. It can be said that the interest rate is the “price” of money. The greater the yield, the greater the risk.

Quirks and complications

It is all pretty straightforward for a fixed-rate investment held to maturity. But things can get complicated very quickly as there are all kind of variations on the theme, such as bonds that pay all their interest at maturity, or zero-coupon bonds that pay no interest but are sold at less than face value (at a discount). And there is a possibility that a bond holder will want to trade her bond before its maturity date. This requires a net present value calculation, taking into account the current yield to maturity, the coupon rate compared to the current interest rate (they fluctuate continually) and changes in risk factors. Bonds are traded broker-to-broker through a computer trading system. That means there is no trading floor and no bond exchange with a single physical location.

In our next post regarding standard investment opportunities, we’ll cover commodities and other “real stuff”, and futures contracts.

Reporter’s Takeaway

• Bonds are a form of “fixed-income” investment, like a loan, providing an income stream over time.

• The U.S. Government is the world’s largest issuer of bonds and has never defaulted on its debt.

• Bonds are bought and sold through dealers using a computer system, not on a trading floor.