Previous posts introduced the markets and the best-known investment vehicles, stocks and bonds. But even if you don’t own one of those investments, you probably have placed a considerable amount of money in a different asset class, although you may not consider these to be investments.

I’m referring to real assets, physical items, the “stuff” we accumulate throughout our life. If you’ve ever sold an item on eBay, you know what I mean. You might have sold a used item you’ve upgraded or outgrown. Or you could have sold a “collectable,” an item you bought in the belief that its value would grow over time (Beanie Babies, anyone?) These are “real” assets.

Real estate as an investment

If you own a home or apartment it is likely that this is your single most valuable asset. Some people view real estate as an investment, buying multiple properties and renting them out to others. But most homeowners buy property to live in. Still, since most of us mortgage the purchase, our equity increases as we pay off the mortgage loan. And because real estate tends to appreciate over time, most of us understand that the home we live in is a form of investment. We expect to sell at some future point, often planning to use the sale proceeds to fund our later years.

The real estate market is a key area for business stories on both the national and local level—after all, everyone has some level of concern about having a place to live. The housing market is tied to the construction industry, which employs a significant number of people. And while overall statistics are important, regional trends in housing vary significantly. That makes the sector an important one to cover at the local level.

Types of commodities

Commodities is an investment class used historically in reference to raw materials: the “stuff” used to make other “stuff.” We’re talking about agricultural products such as, corn, wheat, soybeans, pork bellies (bacon) and frozen concentrated orange juice, among others (That last reference is an homage to a great movie and a good lesson on how the commodities markets work, the 1983 John Landis film, Trading Places.)

Precious metals are commodities. Gold is the most famous, although many argue that gold, held and traded by investors in antiquity, is a special class of investment, both commodity and currency. The first use of gold as currency is believed to date to 600 B.C. Besides their use as currency, and in jewelry and art, precious metals have industrial uses. A class of elements known as rare earths, used in industry for their chemical qualities, are also traded as commodities.

Futures markets

Commodities can be bought and sold over-the-counter in what is known as the “cash” or “spot” market. But investors are more likely to trade commodities by buying and selling contracts for delivery of the commodity at a specific time in the future. This “futures contract” is traded on a futures market. The idea is to reduce the risk for producers and consumers.

For example, the farmer usually plants in the spring. But he does not know what demand will be like when it comes time to harvest in the fall. So he enters into a contract agreeing to supply a certain amount of wheat for a certain price at a certain date after the harvest season. A baker, wanting to assure the ready supply of flour she needs to keep producing during the holiday season, takes the other side of the contract, promising the farmer to take delivery of his wheat.

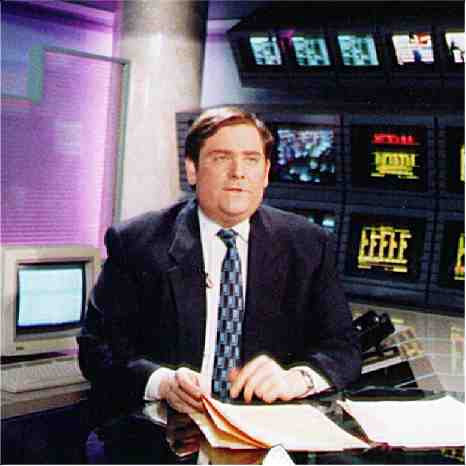

In fact the vast majority of the trading by people wildly waving their hands at places like the Chicago Board of Trade, the oldest American futures market, is done by intermediaries. These speculators try to make money on the price fluctuations which occur in the contracts as, in the case of wheat futures, the growing season progresses and factors such as weather patterns and consumer sentiment affect estimates of supply and demand.

A little history, in 1864, the CBOT listed the first ever standardized “exchange traded” forward contracts, which were called futures contracts. In 1919, the Chicago Butter and Egg Board, a spin-off of the CBOT, was reorganized to enable member traders to allow future trading, and its name was changed to Chicago Mercantile Exchange (CME).

The second half of the 20th century saw a great expansion of futures markets into products designed to meet varied needs for financial risk management. These include futures on treasury instruments, stock indexes and currencies, and are closely tied to the creative of derivative products.

In 2007, the circle was closed as the CBOT and the CME merged into the CME Group.

In our next post we’ll introduce options and other derivatives.

Reporter’s Takeaway

• Investors often buy and hold real assets in their portfolios. Real assets include collectable items, real estate and commodities (such as precious metals), all of which have story potential for financial reporters.

• Real assets are bought and sold in over-the-counter cash markets and in the form of futures contracts on futures exchanges, such as the Chicago Board of Trade.

• One of the most widely held real assets is a home or apartment, which tends to appreciate over time and often represents the largest single investment an individual will make. Regional trends in real estate are particularly worth following.