It’s just a tiny blip for now in the economic picture, but early and serious credit delinquency, particularly among borrowers with lower credit scores, are on the rise, according to the latest quarterly report from the Federal Reserve Bank of New York.

Here are two stories for business reporters to consider: a piece examining the implications of increasing delinquencies, a trend not seen since 2009, and a story explaining the guidelines for consumers on using credit wisely.

Standards loosen, delinquencies rise

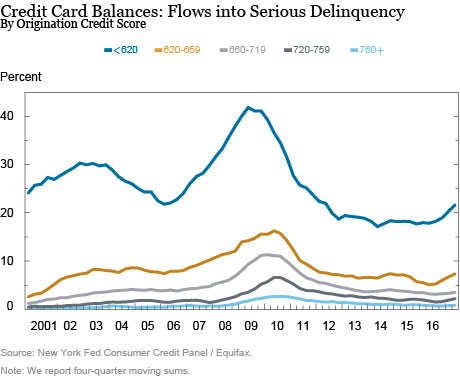

After the Great Recession, lenders tightened the reins on credit for nonprime and subprime borrowers, those with scores below 620 and 660. But as credit standards have loosened, these borrowers are growing steadily delinquent, as this chart from the NY Fed’s blog shows.

Accounts 30 days or more past due exceeded 20 percent of card balances in 2016, and those 90 days or more past due grew 6.2 percent in the second quarter, from 5.1 percent a year earlier, according to New York Fed senior vice president Andrew Haughwout and other Fed economists. That is “potentially concerning, particularly in the context of a strong economy and low interest rates,” notes Haughwout. Will your readers be ready, if credit tightens? How will they manage? Talk to a few local bankers and consumer experts. The report also breaks down the transition into delinquency by state.

Fee, fie, foe, fum

American consumers now have the highest credit card debt in history. As of June 2017, U.S. spenders reached a new high of $1.021 trillion, up from a peak of $1.02 trillion in 2008. That adds up to a growth of 4.9 percent annually, according to the Federal Reserve. Reporters can develop an informative guide for their readers: Define the fee, describe its use and then compare and contrast ways to best use—or even avoid—that fee. For example, to avoid an over-limit fee, set up auto pay in your checking account. The personal finance site NerdWallet featured a helpful listing of eight types of fees.

Budgeting 101

Using easy credit to stretch a budget tempts plenty of consumers—particularly those living paycheck to paycheck. Many personal finance experts recommend the “50/30/20” strategy, explained here by LearnVest.com: Divvy up your dollars into three buckets, one for fixed costs from rent to utilities to car payments; the second for financial goals; and the third for flexible spending (groceries, shopping, eating out, hobbies, entertainment).

But there’s a big problem with budgets, says Dan Weliver at MoneyUnder30.com: No one ever sticks to them. According to a 2013 Gallup survey, only one in every three households even draws one up, says Weliver. Instead he recommends a “simple spending plan” that uses only one credit card to pay bills, or an automated system, to help keep track of your spending. Explore the pros and cons of these options, and other you may find in your reporting.

Reporter’s Resources

• To interview Andrew Haughwort at the New York Fed, contact Betsy Bourassa, bourassa@ny.frb.org, -212-720-6885.

• At the Federal Trade Commission, contact Frank Dorman, consumer fraud & debt collection, 202-326-2674, fdorman@ftc.gov.

• At MoneyUnder30: David Weliver, david@moneyunder30.com, 207-619-4056.

• For credit card information: Matt Schultz, senior industry analyst, CreditCards.com, 512-996-8663, ext. 131.