Community banks are essential to the local economy and play a vital role in the nation’s financial health. They provide business journalists a plethora of stories. To jump-start your reporting, here are national and regional trends regarding local banks.

The number of small banks is shrinking

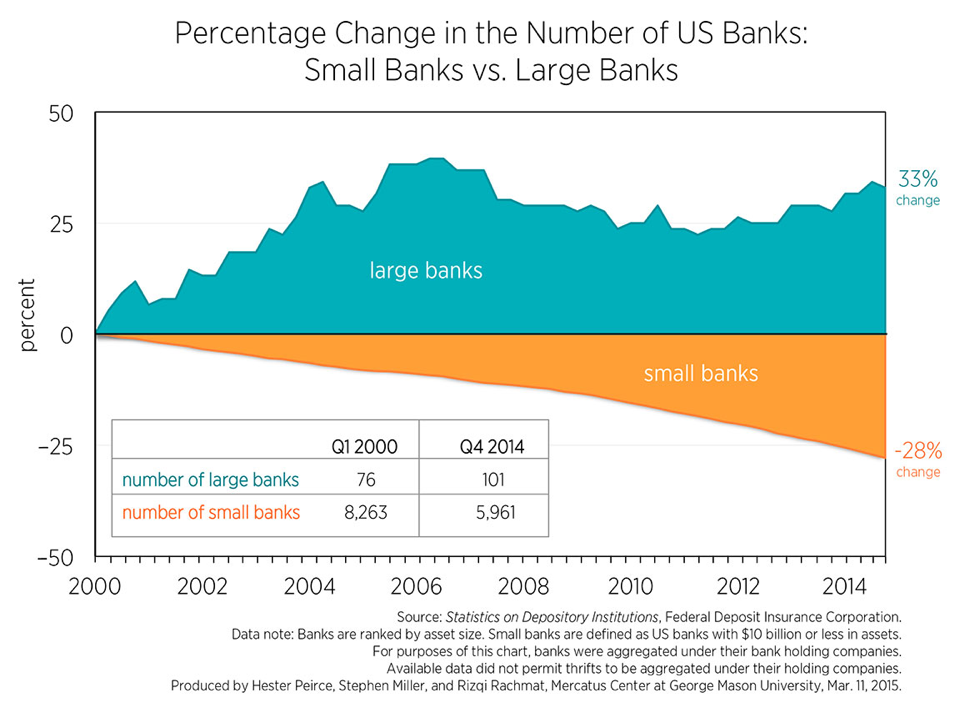

The U.S. banking industry continues to see consolidation among a handful of large banks, a trend in place since the financial crisis. Consequently, small banks are facing a more competitive market and many have either closed or merged. George Mason University reported the number of small banks with assets less than $10 billion has declined 27 percent from 8,263 in Q1 2000 to 5,961 in Q4 2014. At the same time, large banks have grown by 32 percent.

One of driving force is the burden of regulation. Small banks have long complained about excessive industry rules. James Chessen, chief economist of the American Bankers Association, said in a statement that regulatory pressures and greater capital requirements are pushing small banks to sell or merge, according to Bloomberg.

Local businesses rely on local banks

Community banks are typically locally owned and operated, with a focus on the needs of businesses and families in branch locations.

Despite their shrinking numbers, community banks continue to play a vital role in the U.S. lending market, particularly in the agriculture, residential mortgage and small business sectors. According to Harvard’s Kennedy School, community banks account for over half of small business loan volume and nearly half of commercial real estate lending.

In 2016, according to the Federal Deposit Insurance Corporation, community banks expanded small loans to businesses by 2.2 percent, an increase of $6.4 billion. That growth rate is more than twice of non-community banks. Over half of all business borrowing comes from small and mid-size banks. By contrast, the largest 20 banks control 57 percent of all bank assets but allocate only 18 percent of their commercial loans to small businesses.

Agriculture calls for more support

Despite an increase in the growing number of loans community banks make to small businesses, agriculture is in need of more support.

A 2017 Farm Income Forecast released by the United States Department of Agriculture showed net farm income declined by 8.7 percent this year, the fourth consecutive year of decline since 2013. Farm asset values are predicted to fall by 1.1 percent in 2017 while farm debt is set to increase by 5.2 percent, driven by higher real estate debt.

Reuters reported that the White House’s fiscal 2018 budget blueprint could exacerbate these conditions. The USDA will see a 21 percent cut in its discretionary spending.

According to Harvard’s Kennedy School, community banks account for 77 percent of agricultural loans. As farmers struggle, community banks will continue to face a growing demand for lending.

Small banks face a challenging future

According to the Federal Deposit Insurance Corporation, 5,461 FDIC-insured community banks reported total earnings of $5.3 billion in the fourth quarter of 2016, up 10.5 percent from the previous year. Simultaneously, community bank-financed small-business loans grew to $298 billion, an increase of $579 million from the previous quarter.

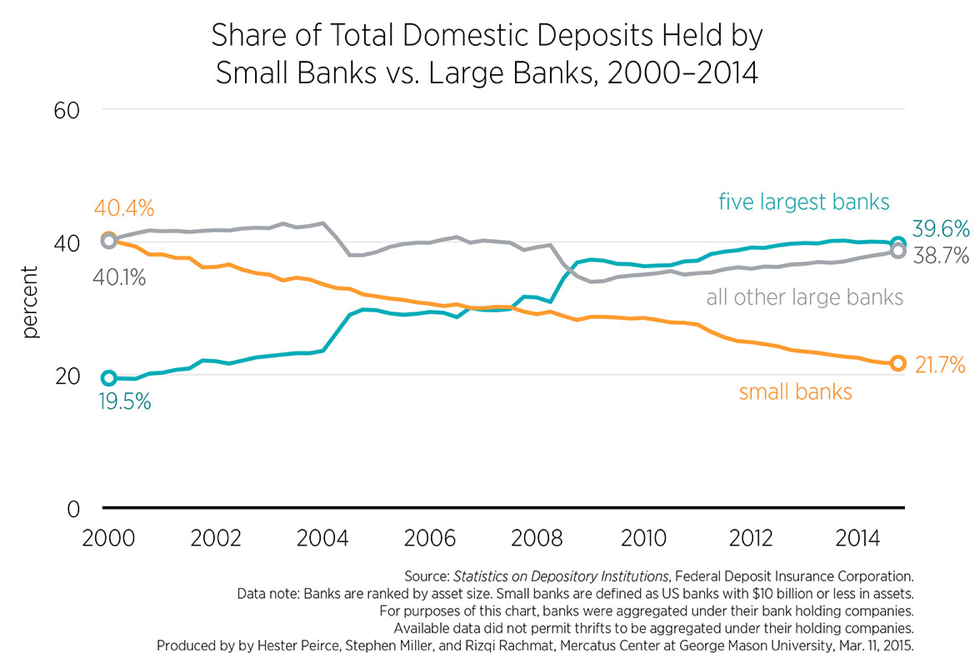

The fact that local banks hold only a small and decreasing percentage of domestic deposits, less than one-quarter of all bank assets, makes it difficult to continue nurturing local businesses. Community banking’s share of domestic deposits has fallen continuously, from 40.4 percent in 2000 to 21.7 percent in 2014. In 14 years, local banks have lost nearly half their share of deposits to large banks.

Some small banks are taking major risks to drive up revenue. Reuters reported that a small Puerto Rican bank replaced Citigroup in servicing the Venezuela government’s international trade operations. This comes at a time when large international banks are concerned about investigations into drug-trafficking and corruption.

Reporters’ Takeaway

• Interview community bankers, small business owners, local chambers of commerce and mayors. Ask about the changes in your region’s community banking sector and how it has impacted business development.

• Reporters in agricultural areas should investigate how farmers are coping with possible loss of USDA support, and current challenges. See how personal relationships between community banks and local farmers have changed over time.

• Deposit market share is a key element to a local bank’s survival. The Federal Deposit Insurance Corporation provides a database for business reporters to get information on the market share of local banks.