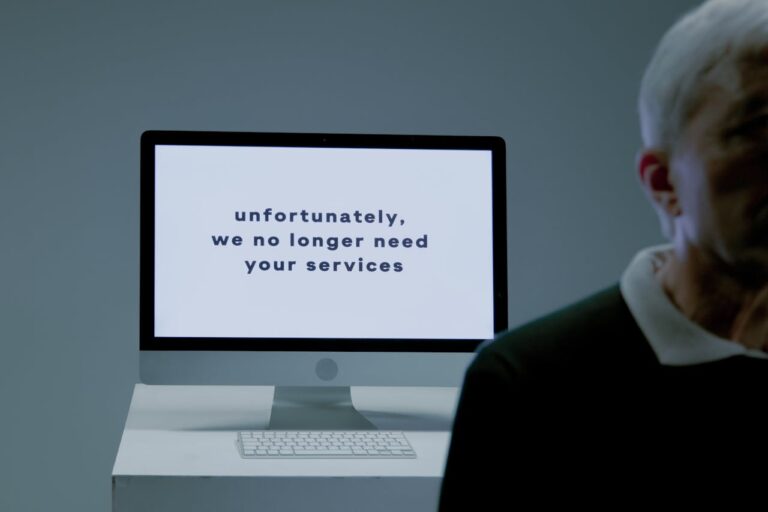

Word last week that Microsoft will be jettisoning 18,000 workers raises the specter of mass layoffs, a frequent occurrence several years ago but one we haven’t heard much about lately.

A few industries stand out in terms of recent job cut numbers, according to the outplacement firm Challenger Gray & Christmas; the firm’s monthly jobs cut report is a trove of data that will let you know how the industries on your beats rank in terms of layoff prevalence. For example, Challenger’s June report notes that entertainment/leisure companies topped the list. What does that say about consumers and discretionary spending?

Casinos, for example, are a struggling sector — in June, Caesar’s Entertainment closed down a big Harrah’s hotel-casino in the Tunica, Mississippi cluster of gambling halls; that cost an already struggling community 1,300 jobs and $40 million in annual payroll, according to a tourism official quoted by the Jackson (Miss.) Clarion-Ledger. And in Atlantic City, which once enjoyed near-exclusivity as a gambling destination along with Las Vegas, the slump is pronounced: two casinos have announced plans to close by September and a third may follow; the race is on to find buyers to revive the properties and keep workers employed. Other job cuts took place regionally. If you haven’t take a look at the casino or entertainment industry in your area lately, you might want to investigate the job scenario are nearby gambling venues. Between the increasingly easy availability of slots in many states and consumer sentiment that just can’t gain traction, will more casinos become defunct? You can use a story like this as an illustration of broader regional economic issues, beyond the single-industry focus.

Same for retail, transportation and other sectors. And note that the Challenger report ranks job cuts by state and region; handy information for adding context to local economy stories.

Fortune jumped out with an interesting juxtaposition of graphics in “Microsoft’s layoffs are huge – or small – depending on how you look at it,” one represents the relative “size” of layoffs since 2000 by raw numbers, the other by layoff figures as a percentage of the companies’ total headcount; in that regard, it says, Microsoft actually ranks as one of the largest layoffs in recent years.

MASS LAYOFFS

Unfortunately for all of us, the federal Bureau of Labor Statistics ceased tracking mass layoffs statistics (MLS) last fall as a result of budget sequestration; the agency’s mass layoff statistics site still is up with historical info, however, if you are looking for numbers for full years prior to 2013. And the MLS program was a cooperative with states; you can contact your state labor department and find the office that reported stats to the BLS to see what they currently are tracking.

And of course, the U.S. Department of Labor’s WARN program – which stands for Worker Adjustment and Retraining Notification Act – requires “companies with more than 100 workers to give 60 days notice of plant closings and mass layoffs.” Sometimes you can get a heads’ up, and don’t forget unions and sometimes industry trade groups can be sources of interesting layoff news.

DailyJobCuts.com is a clearinghouse of sorts for layoff, bankruptcy and closings news – it’s not clear who’s running the site but it seems a decent source of leads, particularly for local or small/medium businesses; you might want to bookmark it.

From a corporate performance standpoint; here’s an interesting Motley Fool article about an analysis of downsizers vs. companies that stayed intact through difficult periods; the “downsizers never outperform,” it notes.

You might want to take a look back at notable layoffs that affected big employers in your region; did the companies benefit from drastically slashing payroll or did sales, revenue and quality suffer. I know one person who works as a non-techie Hewlett-Packard employee; she’s literally doing the work that four people formerly did, knows her work quality is suffering, can never schedule more than one consecutive vacation day due to workload and says most of her colleagues are in similar boats. Yet HP stock is still at less than half its peak and the revenue chart looks like freefall. Makes you wonder.

Why not assess the performance of big job-cutters in your region, and find employees affected in the past – where are they now?