Over the weekend a neighbor hefted a brightly-colored plastic outdoor play set and proudly noted that it had been a bargain purchase at a local thrift shop, just in time for another visit by the grandkids.

Wow, I thought, what an illustration of the timid consumer spending that – despite an uptick in June, as Reuters reported last week – is taking its share of blame for the lackluster pace of the economic recovery. That these affluent retirees – both with pensions and Social Security along with other assets – have taken to pinching pennies – makes me wonder how many consumers are reining in their pocketbooks out of similar fears.

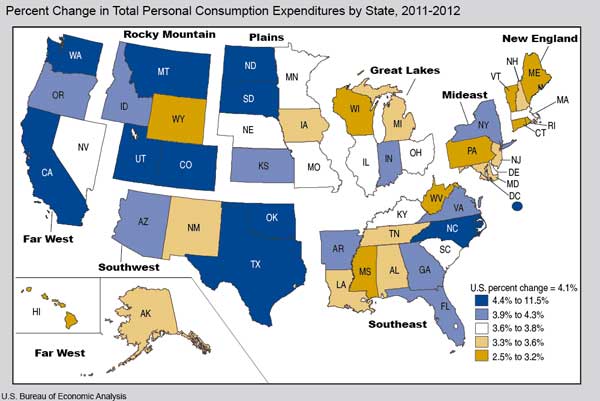

If you’re into a deeper look at consumer spending and the secondhand economy, fate is dishing up a few good news pegs over the next week. On Aug. 7, the Commerce Department’s Bureau of Economic Analysis released its first-ever state-by-state breakout of consumer spending data: Personal Consumption Expenditures by State, 1997-2012 (Prototype Estimates). As the release said:

‘For the first time, we now have rich data on consumer spending decisions in each state, giving us a snapshot of consumer confidence in our economy,” said U.S. Secretary of Commerce Penny Pritzker. “The new report BEA released today will help businesses make smarter decisions about hiring and investing. Unleashing more of our data and making that data more accessible are key Commerce Department priorities, both of which will help strengthen U.S. economic growth, job creation and competitiveness.” ‘

Check out the BEA newsroom to sign up for e-mail releases or locate an analyst to help you parse the numbers. The BEA data to be released Thursday will cover 1997-2012; a substantial period for tracking trends in per-capita spending in a variety of categories.

Meanwhile, a just-out Gallup survey found that 40 percent of respondents said they are purchasing used goods to save money – no comparison to results of past years’ surveys were published, unfortunately. (But the Gallup site does offer quite a bit of interesting survey data on consumer behavior; worth bookmarking for future context.)

With August being not only the month in which many of those miles-long yard sales are held – in fact National Garage Sale Day is Aug. 9 according to some calendars – but also home to National Bargain Hunting Week (Aug. 4-10) and National Thrift Shop Day, there’s no shortage of news pegs, even if they are those goofy industry-generated observances.

Why not perform a check-up on area secondhand stores and talk with consumers in your area about why and how they’re substituting used for new? For this piece I wouldn’t focus on collectibles, antiques or vintage items, but the way people are filling everyday needs with used goods. A sign I pass every day lately is touting “used tires – $20” for cash-strapped commuters; that’s evidence to me that tough times aren’t over. And a recent impulse stop at a Habitat for Humanity Re-store made it clear that lots of people were willing to consider used furnishings, hardware, lighting and building components for those DIY projects.

How are charity thrift stores faring? Here’s an interesting piece from Washington’ state’s Whidbey Island about area thrifts collaborating on a treasure-hunt promotion. It includes a map of area stores for consumers, drawings and other elements. Are any of your Main Street or strip-center merchants trying similar promotions, and what’s the motivation — fear of waning trade, or a desire to capitalize on strong consumer interest in secondhand shops?

And how’s the competition from for-profit resales shops? A year ago the market research firm IBISWorld predicted that the economic recovery would lead to the waning of revenue for used-goods outlets; I wonder though with stagnant wages and the fact that most newly created jobs are part-time and low-wage, how that’s panning out. Have local operators seen much change to traffic?

You also can haunt garage sales over the next couple of weeks and talk with sellers about what’s hot and with buyers about their motivation. Fun pastime or economic necessity?

The National Association of Resale Professionals is the industry trade group, it may offer leads to members or a national perspective as well as statistics.