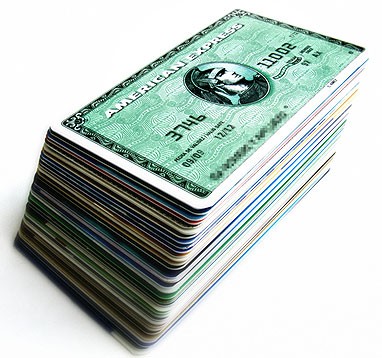

Big banks are reporting results this week. Reuters says that many are paying more attention to a neglected business: credit cards.

According to writer David Henry, “JPMorgan Chase & Co, Citigroup Inc and other big banks are making more credit card loans, after years of focusing mainly on customers who paid off their balances each month. Lenders hope that in an era when consumers are conducting more of their banking online and less in branches, an increased emphasis on credit cards will help them sell more products to their customers.”

He notes that after excluding the businesses they are shedding, Bank of America and Citigroup now make about 25 percent or more of their income from credit cards. That is up from about 15 percent before the financial crisis.

Of course, many consumers paid off credit cards during the recession, and vowed to make less use of them as they got back on their feet. But marketing is on the rise, again. According to Mintel, a market research firm, banks are set to mail 17 percent more offers for credit cards this year compared with 2010.

It’s easy to follow up on this story: just check your own mailbox and see if you’ve gotten more offers. With the holiday season fast approaching, will consumers take advantage of what banks are offering?