Among business leaders, Warren Buffett’s annual letter to Berkshire Hathaway shareholders is a must read. Analysts and investors flock to the 30-page document for Buffett’s view of the economy and where he sees his company headed in the future.

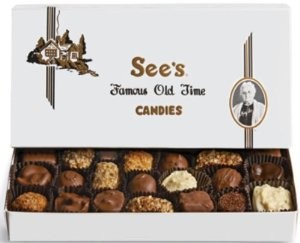

The letter also has a folksy side and this year, the Berkshire Hathaway chairman offers some insight about one of his sweetest investments: See’s Candy.

Although it’s often thought of as a California brand, it’s been owned by Omaha-based Berkshire Hathaway since 1972. Here in Phoenix, See’s has several shops including an outlet store a short drive from the Cronkite School (make mine all dark chocolate, please).

At the time Buffett was considering a bid, See’s was earning about $4 million a year before taxes, with $8 million in assets. Buffett writes that as the leading West Coast candy maker, See’s had a huge asset that didn’t appear on its balance sheet: “a broad and durable competitive advantage that gave it significant pricing power.”

He was certain that with only minimal investment, “See’s could be expected to gush cash for decades to come.”

There was just one problem: Buffett only wanted to pay $25 million for See’s and the controlling family was demanding $30 million. Had they not reached a compromise, Buffett says his caution “could have scuttled a terrific purchase.” But luckily, the owners accepted his bid.

Fast forward to 2015. In the past 43 years, See’s has generated $1.9 billion in pre-tax earnings, on capital investments of just $40 million. See’s, he writes, has been able to fund Berkshire’s purchases of other businesses, which in turn, have generated even more profits. “Envision rabbits breeding,” writes Buffett.

And, through watching See’s in action, Buffett says he gained a business education about powerful brands that has opened his eyes to many other investments.

So, when you wonder about Buffett’s success, you can credit Black Forest truffles, Rocky Road eggs and Almond Royals.

By the way, Berkshire Hathaway shareholders are also in love with See’s, one of the brands they can purchase during the company’s annual meeting. Last year, they snapped up 13,440 pounds of candy in nine hours. Buffett, who is offering his shareholders an expanded marketplace this year, thinks a new record is likely to be set.