Financial lessons from Enron

The collapse of Enron, while dated, provides a graphic lesson: Analyze the financial statements of a company because they often offer reporters a different perspective from widespread capital market rhetoric.

Enron executives Kenneth Lay and Jeffrey Skilling were convicted of fraud in 2006 for misleading the public about the company’s financial health. In this article let’s explore Enron’s financial statements before any alleged fraud and ask: Were there financial statement signals indicating that Enron was a failing business, unable to generate wealth?

The answer is yes. Obvious signals existed in the financial statements that Enron was failing as a viable business. Not surprisingly, investors who studied Enron’s financials had ample time to sell their shares before the fraud allegations and bankruptcy. Many investors did, causing Enron’s stock price to drop from a high of about $90 per share to about $15 a few weeks before its managers announced that it was restating its financials due to misleading (fraudulent) accounting disclosures.

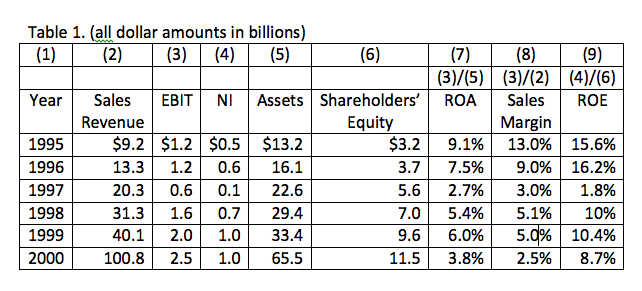

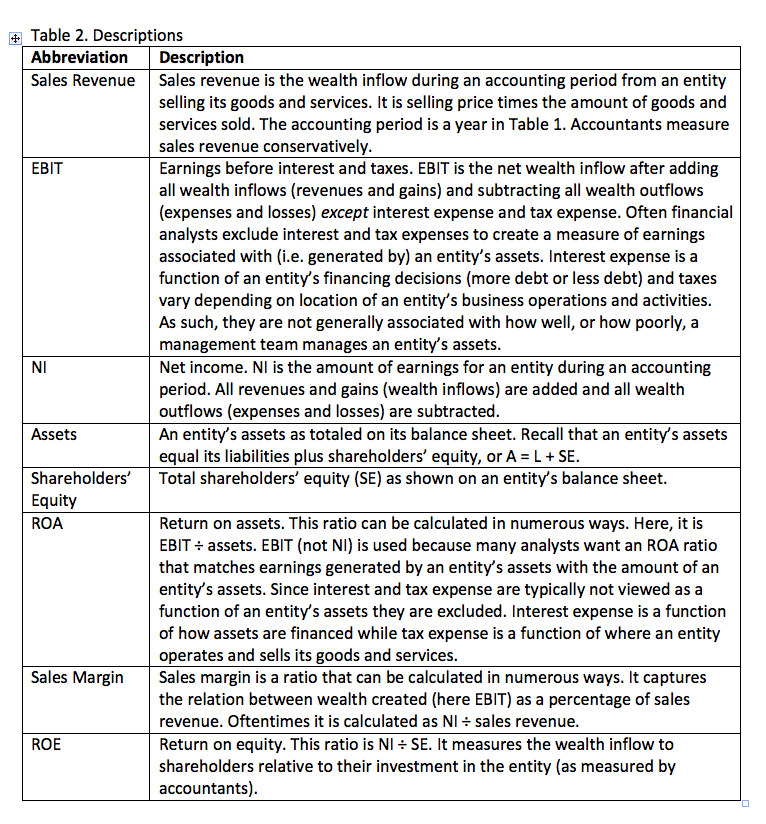

Table 1 lists several financial accounting results for Enron over the six years preceding the revelation of misleading (fraudulent) accounting disclosures in late 2001. These numbers are the original, fraudulent amounts.

Enron as a failed business: analysis

Even the fraudulent financial statement amounts in Table 1 offer a compelling story that Enron was failing as a business before bankruptcy in late 2001. Consider these observations:

- Sales revenue in column (2) increased approximately 10 times during 1995 through 2000 from $9.2 to $100.8 billion. Yet net earnings, whether measured as EBIT in column (3) or NI in column (4), only doubled. The clear observation: Enron couldn’t generate much wealth on its new sales for several years.

As a reporter, a reasonable question would be, “Why haven’t Enron’s earnings, whether measured as EBIT, NI (or other reasonable measures as it turns out) also increased 10 times or more?” Enron’s management was telling a business story that Enron would monopolize information, and thus generate superior earnings. Given that assertion, earnings should be increasing faster than sales revenue.

We can glean this same analysis from the sales margin ratio in column (8). This margin dropped from 13.0% in 1995 to 2.5% in 2000. As a reporter, you could compare this sales margin performance to other entities, analyst projections, Enron management projections or the general population of U.S. public companies. With any reasonable comparison, you would find Enron underperforming. Although not a direct comparison because the companies live in different industries, even Walmart, the low-price retailer known for its low sales margins, generated similar (5.0% to 6.0%) results over this time.

- Enron grew in size. Its assets increased by about five times, from $13.2 to $65.5 billion. As its assets grew, Enron issued new shares, causing shareholders’ equity to increase by about 3.5 times. Growing in size was a stated goal of Enron’s management and at least on this dimension they showed success. At the time of its bankruptcy, Enron was one of the larger entities in the United States.

- As its sales revenue, total assets and shareholders’ equity grew, it failed to generate wealth. Column (7) highlights Enron’s ROA, which dropped by about half, from 9.1% to 3.8%. Any reasonable comparison to other entities, analyst projections or Enron management’s stated business goals would hint to onlookers the company failed to earn an adequate return on its assets.

- Column (8) highlights Enron’s ROE, which, like ROA, dropped by about half, from 15.6% to 8.7%. Again, it was not generating wealth for its shareholders at a competitive rate. Any reasonable comparison to other entities would highlight how poorly it performed in terms of generating ROE for its shareholders.

The learning lesson is graphic: As a reporter, carefully study the financial statements. Press releases by Enron’s management about its goals and aspirations attracted many capital market participants to the “Enron story” (e.g. it was cited as one of the U.S.’s best and most innovative companies). But the financial statements continuously showed the company failed to generate wealth at a competitive rate. Again, the Table 1 amounts include the fraud.

If you would like to explore a much more technical analysis of Enron’s financial statements that reached the same conclusions (Enron wasn’t creating wealth), you can find an excellent (and free) example at Off Wall Street Consulting Group, Inc. Scroll to the bottom of this page for their excellent ENE – Enron Corp. report. All of the analysts assessments occurred before capital market participants knew of any fraud.

Last, many investors, in particular Warren Buffett, refuse to purchase shares in an entity unless it has generated superior wealth, as documented in its financial statements. As Buffett has stated, he buys viable businesses that are generating wealth, not untested ideas. Studying the financial statements shows that Enron was an interesting business idea that was failing and it included a fraud.