You can discover numerous business article topics by analyzing business activities, such as property, plant and equipment, then comparing your analysis with managers’ representations about the business. It isn’t unusual for financial statement results to not fully support strategies and aspirations of managers. Let’s focus on PPE because it is a large asset for many entities.

Accounting for Property, Plant and Equipment (PPE)

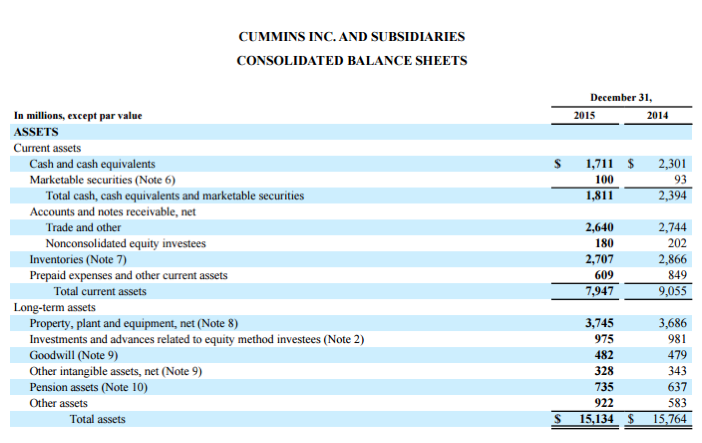

PPE consists of tangible assets used primarily to manufacture inventory. Here is a partial balance sheet for Cummins, Inc., a manufacturer of diesel engines commonly used in large semi-trucks:

PPE is the largest asset, at $3,745 million ($3.745 billion) or 25 percent of total assets. Large PPE balances are typical for manufacturing entities.

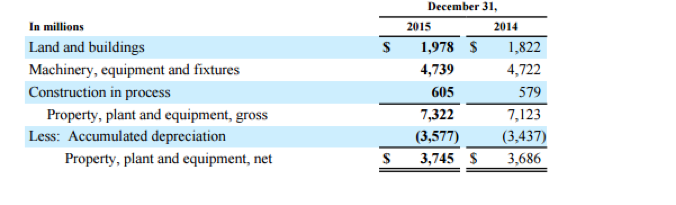

The PPE line item is shown “net” referring to gross PPE less (net of) accumulated depreciation. Details are shown in note 8 to Cummins’ 2015 annual report:

Gross PPE is $7.322 billion of which $3.577 billion has been estimated to have been used (depreciated), leaving PPE, net at $3.745 billion.

What these various numbers represent

Gross PPE amounts represent costs to acquire and place PPE in service. Land and buildings, for example, cost $1,978 million ($1.978 billion) to acquire and place in service. Costs to place PPE in service include transportation costs, setup costs, testing costs, etc. Numerous entities choose to build some of their own PPE assets. While constructing these assets, costs are categorized as construction in process (CIP), signaling to investors that these costs have been incurred but don’t represent assets in use. Once in use, CIP costs are categorized to buildings, machinery, equipment or fixtures. You may be surprised to learn that Walmart has built some of its own plant and equipment. Analyzing CIP may offer signals about management’s growth activities for an entity.

While we account for PPE using cost, many investors prefer fair value as a more meaningful number than cost. Fair value is an estimate of the current value of an asset (e.g. market price if there is a market for an asset). The issue is interesting. Cummins, for example, may have purchased land 100 years ago, and the 100-year-old cost amount is included in its current balance sheet. It’s difficult to imagine how such a number might be relevant to investors analyzing Cummins today. Further, an investor can’t tell if Cummins has any such old cost numbers in its PPE account nor can an investor tell from the financial statements or footnotes what any such land might value today. Cost versus fair value accounting does highlight potentially interesting business article topics that inform investors of “hidden value” in entity-owned land, particularly one as old as Cummins. There are probably entities whose stock price is lower than the liquidation value of terminating the entity and selling its land holdings.

Reporters can generate potential business articles by analyzing changes in PPE gross costs from year to year and comparing PPE balances with competitors. In particular, the change in gross PPE should support management’s announced strategies. If a management team announces that it intends to grow an entity, then PPE gross amounts should increase. If PPE amounts don’t grow, that may indicate early problems implementing the growth strategy. If they do grow, but then returns (profits) don’t follow, that can also signal an early warning.

The Concept of Depreciation

The idea of depreciation is to record the cost of plants and equipment wearing out. Property (land) isn’t depreciated because it is assumed not to wear out. Sometimes business persons (incorrectly) assert that depreciation isn’t a real cost because no cash outflow exists. Consider this intuitive example: Suppose you owned a restaurant that delivered pizza using a delivery vehicle the restaurant owned. Obviously the vehicle would wear out as your staff used it. As you analyze the price to charge for a pizza, you would readily agree that you need to charge a selling price that allows you to recoup the cost of the delivery vehicle wearing out. Otherwise, you will assume profits but eventually realize the profits are nonexistent because replacing the delivery vehicle when it wears out will consume profits.

In its 2015 annual report, Cummins estimated depreciation for the year. Referring to the illustration from note 8, it added 2015’s depreciation to prior years to update the accumulated depreciation amount. At the end of 2015, accumulated depreciation is $3,577 million (or $3.577 billion). We can then estimate that Cummins’s PPE was $3,577 ÷$7,322 = 49 percent used, with 51 percent remaining. Recall that $7,322 million ($7.322 billion) is the gross cost of PPE. For comparison, the percent of plant and equipment used through the end of 2014 was 48 percent. It doesn’t appear that Cummins invested substantial incremental amounts into new PPE during 2015. We observe corroborating information analyzing gross PPE changes from 2014 to 2015 where there is little change. Perhaps an interesting article topic would explore whether these observations support Cummins’ management strategies and plans, or lessen its competitive position. Other information in the financial statements also concludes Cummins’ slow growth.

Measuring Depreciation

We can estimate depreciation using several acceptable methods but most entities use straight line depreciation. The calculation is straightforward:

- (Cost – Residual Value) ÷ Useful Life = Annual Depreciation Cost.

Cost is the original cost to place the asset in service. Residual value is the estimated value of the asset when the entity is finished using it. Useful life is the number of years we expect to use the asset. If an asset costs $110, we use it for five years and estimate its worth as $10 at the end of its five-year useful life, then annual depreciation is ($110- $10) ÷ 5 = $20 per year.

An analysis of PPE can highlight differences in how entities use PPE. Comparing Singapore Airlines and American Airlines, Singapore Airlines states in its 2015/16 annual report footnotes that it depreciates most of its aircraft over 15 to 20 years while American Airlines depreciates most of its aircraft over 25 to 30 years. Both use straight-line depreciation. The difference in useful lives reflects different operating strategies. Singapore Airlines historically has competed in part by maintaining new aircraft (a fact that they advertise) while American tends to use aircraft for much longer. But Singapore Airlines’ useful lives for aircraft have been increasing over the last 15 years as their strategy of using new airplanes has changed. In their 2000/01 annual report, Singapore Airlines depreciated aircraft over 10 years. Changes in useful lives signal a change in strategy, perhaps leading to interesting business article topics.

Age of PPE and Return on Assets (ROA)

Managers often cite improvements in ROA as evidence of their successful management activities. But investors (and business journalists) must caution because almost all ratios are easy to manipulate. In the case of ROA, all managers need to do is let PPE wear out (i.e. do nothing). When new, managers record plant and equipment at its gross cost. But each year it is depreciated and recorded at a lower and lower asset value. If the plant and equipment still functions about the same, as if it were new, then returns (income) would remain about the same yet be divided by assets that are decreasing each year, causing ROA to show a steady increase. Managers could cite improvement in ROA as support for their management skills when all they are doing is letting plants and equipment age. Analyzing PPE disclosures as done in this article will highlight this potential problem with ROA.