After the shock of the financial crisis, Americans began weaning themselves off plastic. In each of the 19 consecutive quarters since 2008, however, debt has been nudging its way back up, according to the most recent quarterly survey by the Federal Bank of New York.

Some economists believe that increased spending signals optimism as the economy expands; others warn of risks. Draw your own conclusion as you look into one or more of these three story angles:

Puzzling pieces of the U.S. debt picture

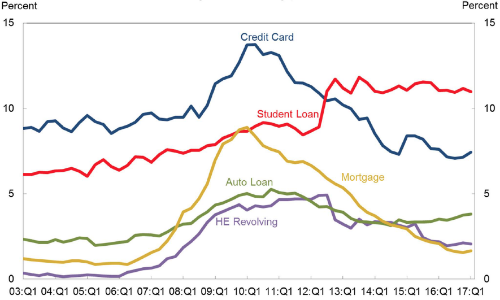

Except for student loan debt, overall debt is declining, and there are very low delinquency rates for most types of debt. One positive number is mortgage debt, which consumed 73 percent before the financial crisis, but now has declined to 68 percent.

But debt is making a comeback. However slight, serious delinquencies on auto loans and credit cards (past due by 90 days or more) are inching up, proving that the decline in consumer debt from 2008 to 2013 was merely “an aberration” from typical American spending habits, says the New York Fed. In the first quarter of 2017, household debt balances grew 14 percent above the trough seen in the second quarter of 2013 and nudged ahead of the previous peak of $12.68 trillion reached in the second quarter of 2008, to $12.73 trillion. What percentage of debt should consumers spend in various categories (housing, transportation, etc.)? These numbers also present an opportunity to review the importance of a budget with your readers.

So young—and so in debt

Student loan debt tops the list. “Seriously delinquent” debt, meaning debt past due 90 days or more, consumed a modest 3.3 percent of total household debt in 2003, but now has tripled to nearly 11 percent. Unlike a mortgage, which can be shed through foreclosure or restructured with a home equity loan or a lower interest rate, there are few alternatives for refinancing student loan debt. In addition, the consequences of high debt could prevent burdened borrowers from buying a home or starting a business.

The average student debt in 2015 was $30,100, according to the Institute for College Access & Success. Their Project on Student Debt lists average debt by state, but debt balances of $50,000 or $100,000 are not out of the ordinary. About one in 10 student borrowers are behind on repaying their loans, the highest delinquency rate of any type of loan tracked by the NY Fed’s quarterly household debt report. Look at the delinquency rate in your area, and talk with borrowers who are struggling to pay off their loans about the impact that debt has on their careers, their lives and their futures.

Auto loan debt on the rise

Automakers who dangle low-interest rates to attract buyers got their wish in 2016, when car loans generated $142 billion, the largest number in the 18 years that the New York Fed has been tracking household debt. That surge also created more loan delinquencies in the fourth quarter of 2016—$23.27 billion—the highest since the height of the financial crisis in 2008.

Talk with auto dealers in your area about how they approve buyers for loans. Also contact credit counseling services, to see if they are counseling more consumers struggling to meet their monthly auto loan.

Reporter’s Resources

The Federal Reserve Bank of New York, referred to the New York Fed, is one of 12 regional banks of the Federal Reserve System. It is responsible for formulating and implementing monetary policy, supervising banks and bank and savings and loan holding companies, and providing financial services to depository institutions and the federal government.

The U.S. Department of Justice offers a database of approved credit counseling agencies.

The National Foundation for Credit Counseling is a nationwide organization that provides credit and debt counseling for consumers.

The Project on Student Debt, an initiative of The Institute for College Access & Success, offers a state-by-state breakdown of student loan debt.