In my recent post on mutual funds, I noted that John Bogle disrupted that industry with Vanguard, a mutual fund company that specialized in low cost index funds designed to mimic rather than outperform major market indexes. The other mutual fund companies responded with their own index funds, and there is intense competition between them. This typical marketing page from Fidelity compares its fund costs with those of Vanguard.

Mutual fund shares vs. ETFs

You may notice the Fidelity page lists both mutual funds and something called ETFs. Exchange Traded Funds are another refinement of the fund category. They will certainly figure into your reporting on the fund asset class because they are by some measures the most popular of all exchange traded securities.

Investors generally buy and sell mutual fund shares by placing an order with the fund manager or his agent. These orders are usually filled once per business day at the fund’s Net Asset Value, the value of a fund unit. The fund’s NAV is computed by recording its price to reflect its current market value (called marking to market), usually using the last trade price at the close of the regular trading session of the New York Stock Exchange (4 PM weekdays) and dividing by the total number of units outstanding. Fees (“loads”) and commissions may be charged against the transaction.

Exchange Traded Funds are a different animal. They are still based on a portfolio shared by all holders, contractually convertible to the value of the share. But they are traded just like a stock on exchanges. That means they can be traded continuously by holders and are accounted for just like stock shares. This provides easy liquidity in a world where prices can change rapidly.

The Toronto Stock Exchange created the first ETF in 1990. The first American ETF was the Standard & Poor’s 500 Depository Receipt, which trades under the ticker symbol “SPY.” Created in 1993, it is designed to mimic the S&P 500 index. A little footnote here: The indexes are intellectual property and their names are trademarks. Dow Jones was reluctant initially to license its better-known averages. S&P was more receptive and as a result the “spider,” a play on SPDR, is the king of the ETF world. It didn’t hurt that S&P mounted a big marketing campaign to promote the fund, using a logo featuring a spider, aimed at retail investors.

ETF explosion

The number of Exchange Traded Funds is approaching 3,500. That is nearly the number of individual stocks traded on the NYSE and the NASDAQ. It is not exactly a fair comparison because, admittedly, more than 10,000 shares trade on the informal, over-the-counter market. And ETFs have expanded in recent years to include a host of non-stock assets such as commodities, currencies and real estate as well as actively managed funds.

Still, it is a very large number. There are web sites entirely dedicated to tracking ETFs. ETFdb.com is one of my go-to sources. And the number of traditional mutual funds is even larger.

Are funds hazardous?

So, the question is, how many is too many? It’s a good question. And one ripe for investment stories. The slicing and dicing of indexes into segments and sectors and sub-sectors is profitable for the index licensing companies and for any financial services companies which profit on transaction volume. But I wonder if, by the time you’ve created a portfolio of a few dozen funds, you’ve not gone right back to the stock-picking, active portfolio management style of investing you were trying to escape.

Warren Buffet famously holds that an investment in a broad index fund makes the most sense for more retirement-minded investors. Investing years ago in Buffet’s Berkshire Hathaway, itself kind of a fund company, would have been a smart move.

But there are detractors and academics have been asking questions about the effect the funds—specifically index investing—are having on the overall economy. Two University of Michigan business school professors and a management consultant studying bank ownership and competition found that banks whose shares are often included in index funds tend to charge higher fees. They believe inclusion in an index fund reduces competition and encourages the banks to charge consumer more.

A Harvard Law Review essay looked at the airline industry and reached a similar conclusion: Index funds tend to reduce competition in the sector where there are a limited number of players and most are included in the funds. Still another study looked at commodity markets and found that firms using commodity indexes to hedge their risks tend to make worse production decisions and earn lower profits.

Could our use of index funds, indicating a willingness to settle for average returns rather than try to beat the market, be taking some of the zing out of our economy? Stories trying to answer that question should make interesting reading in the years ahead.

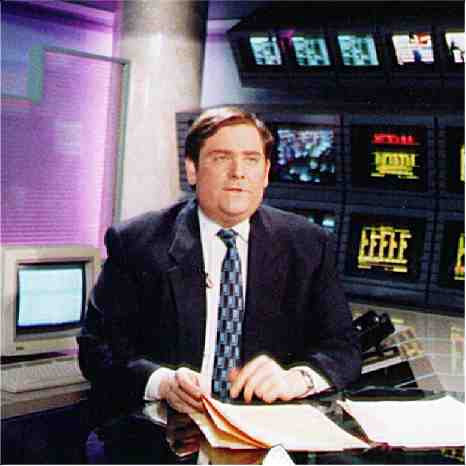

In his longtime role as New York Bureau Chief and Senior Correspondent for public television’s Nightly Business Report, Scott Gurvey covered the financial markets, business and the economy for the first and longest-running daily program dedicated to financial news on broadcast television. Currently Gurvey writes for various online sites, teaches the next generation of journalists and advises companies and nonprofits on media relations, communications strategy, ethics, newsroom operations and online application design and practice. His blog, “Public Offering,” lives at http://blog.scottgurvey.com, and Gurvey has been known to Tweet at @scottgurvey, from time to time.