The world’s leading computer chip manufacturer is coming to Phoenix. Will it be enough to make the region a world-class semiconductor hub?

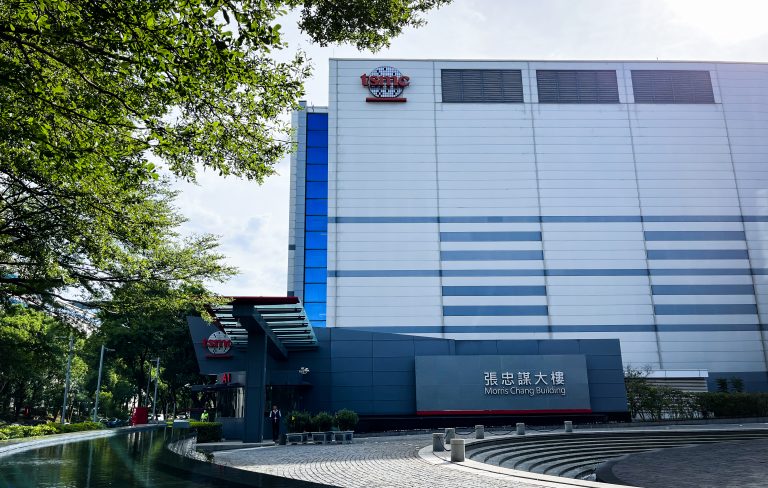

Taiwan Semiconductor Manufacturing Co., which produces the chips found in everyday electronics from smartphones to microwaves, is in the process of building two highly publicized plants in Phoenix. With its arrival, the Phoenix metro area is primed to become the No. 1 region for semiconductor manufacturing in the U.S.

But TSMC doesn’t work alone: The tech giant relies on an extensive network of highly specialized smaller companies that help create the chips that the world literally runs on. And before Arizona can truly become a globally competitive chipmaking market, it will need to attract more of those companies.

While many of TSMC’s biggest suppliers have already started arriving in the Valley, others are still deciding if and when to follow suit. So far, about 20 semiconductor companies have officially announced they will begin operations in Arizona and about 20 more are in the pipeline, according to the Greater Phoenix Economic Council (GPEC), which drives economic development in the region.

But the organization is hoping for more. Many more.

“Over time, I think you will see hundreds of new companies,” said Chris Camacho, president and CEO of GPEC. That will likely include both established businesses and startups that don’t yet exist, Camacho said.

Such growth will be necessary if Phoenix is to become globally competitive in the semiconductor space. TSMC regularly worked with over 1,200 suppliers in 2022, according to a company report.

‘Big bring the medium, medium bring the small’

Arizona’s business and political leaders see TSMC’s unprecedented $40 billion investment as an initial step in the long-term goal of transforming the Phoenix metro into a semiconductor capital and breathing new life into U.S. chip production.

Camacho of GPEC said the regional growth will likely occur in four phases: first, the arrival of TSMC itself; then its main suppliers; then companies that handle downstream testing, quality assurance and packaging; and finally, tangential companies drawn by the prevalence of chips in a wide range of products.

Aside from TSMC, the Phoenix region is already home to major semiconductor companies like Intel Corporation, NXP Semiconductors N.V. and Onsemi. Most recently, in November, Amkor Technology, Inc. announced plans to build a $2 billion testing and packaging facility in Peoria. Other states, such as California, New York, and Ohio, also have their own growing semiconductor industries.

Yet the U.S. semiconductor supply chain is still at risk in several areas: materials, wafer fabrication and packaging, assembly, and testing, according to the National Semiconductor Economic Roadmap, a 2022 report issued by the Arizona Commerce Authority.

Raw materials extracted in the U.S. are often sent abroad for processing before being brought back to the U.S., said Raghu Santanam, a professor and senior associate dean at Arizona State University’s W. P. Carey School of Business and an author of the NSER report. For example, copper, an important ingredient for semiconductors, is mined in Arizona but typically not processed locally.

“On the materials side, definitely there is a need to rethink how we are doing this,” he said.

Localizing more aspects of the supply chain— whether that be in Arizona, in other parts of the U.S. or in other nearby countries — could minimize costs and improve sustainability, Santanam said.

Given that about 40 companies have already started making their way to Arizona before TSMC’s first factory is even open, Santanam said he wouldn’t be surprised if Arizona gains over 1,000 more semiconductor-adjacent companies in the next 10 years.

“There is a critical inflection point. And once you achieve a certain critical mass, that growth explodes,” he said.

Several partnerships have also been formed to recruit more Taiwanese businesses to Arizona, including semiconductor companies. In March, Arizona Gov. Katie Hobbs announced the opening of a new Arizona-Taiwan trade office in Taipei. And in August, GPEC signed an agreement with Startup Island Taiwan, a government-backed organization that supports Taiwanese tech entrepreneurs.

With TSMC soon opening its doors in Arizona, it’s only a matter of time before Taiwanese businesses of all kinds begin arriving, said Allen John Ku, director of Startup Island Taiwan.

“In Chinese we call it, ‘Dà dài zhōng, zhōng dài xiǎo (大帶中,中帶小),’” Ku said. “‘Big bring the medium, medium bring the small.’”

The race to revamp domestic chip production

In recent years, strengthening the U.S.’s semiconductor supply chain has become a priority of federal policymakers who recognize its national security and economic importance.

In 2022, Congress passed the landmark CHIPS and Science Act which provided billions in funding for domestic chip production. The law has so far resulted in over $200 billion in private investments to expand the nation’s semiconductor ecosystem, according to the Semiconductor Industry Association, which advocates for the U.S. chip-making industry.

Before the CHIPS Act was passed, roughly 75% of the world’s semiconductor manufacturing capacity was concentrated in East Asia, especially China, Taiwan and South Korea, according to a 2020 research paper by SIA and Boston Consulting Group.

The resurgence of the U.S. chipmaking ecosystem has not been without growing pains. TSMC is currently facing a number of challenges in Arizona, including a shortage of specialized workers, clashes with American labor unions and concerns over differences between Taiwanese and American work culture. It remains to be seen whether those challenges will affect Arizona’s semiconductor ecosystem in the long run.

In the meantime, industry experts are encouraging policymakers in the U.S. to continue investing in domestic chip production, such as by providing tax incentives to chip-making companies, continuing to build a specialized workforce and promoting innovation and collaboration among suppliers.