Investment Accounting

Last week we explored the accounting for debt securities. Like investment in debt, many entities invest substantial sums of wealth into equity securities. Let’s explore the accounting for equity investments, including issues capital market participants encounter interpreting the accounting. There are similarities with the accounting for debt and you might also be interested in last week’s article entitled “Investment in Debt Securities.” (The accounting for equity investments is complicated, so we’ll defer discussing consolidation accounting until next week.)

Accounting for Equity Securities

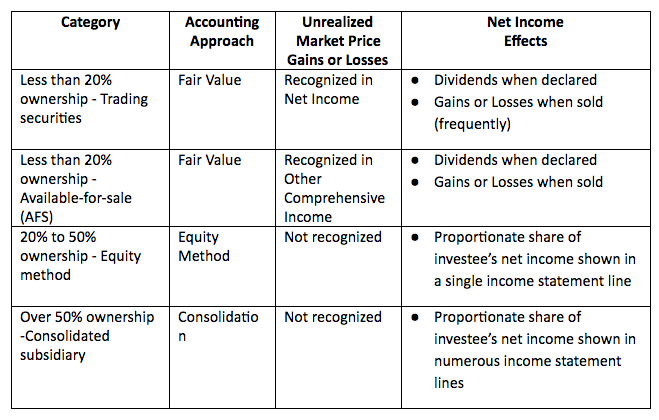

When managers purchase equity securities they record them as an asset at the price paid. They then classify the equity securities into one of four categories as shown in the table. These four categories are important because the accounting differs among them.

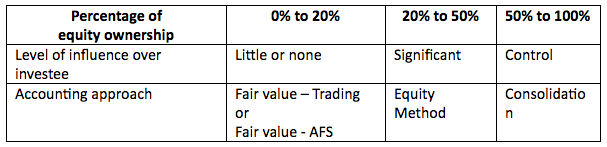

Like debt, the different categories and accounting exist because the FASB acknowledges that entities purchase equity for different reasons. The key perspective the FASB has taken when an entity purchases equity is to categorize equities (and account for them) based on percentage of ownership signaling level of influence over the investee (the entity whose stock was purchased).

In a diagram:

Let’s discuss each category and at the same time the notion of percent of ownership and level of influence to help us better understand the accounting.

Trading Category

Suppose an entity purchases a few shares of stock in another company. The ownership percentage is small, less than 20 percent of the investee entity’s outstanding shares, thus the purchasing entity is assumed to have little or no influence over the investee. The FASB then reasoned that fair value is an appropriate method for measuring the value of the investment because the purchasing entity has no influence over share price. As we’ll discuss, when the purchasing entity has influence, fair value isn’t utilized. Fair value means that the value shown on the balance sheet is the market price of the equity shares at the date of the balance sheet. Contrast fair value with, say, property owned by the entity, which is shown on the balance sheet at historical cost. While most assets are not recorded at fair value, many capital market participants agree that fair values are sensible for trading securities. Since the purchasing entity intends to earn short term trading gains they record any short-term share price gains or losses as part of net income.

Very few entities hold trading securities. As mentioned in the “Investment in Bonds” article last week, managers like to have control over net income. They want control because they often earn bonuses based on earnings and are expected to attain certain levels of earnings by security analysts, banks, creditors, customers and equity investors. The problem with trading securities is that any market price change is reflected in net income. If market-wide bad news occurs during the last week of the year, then the entity would record the decrease in fair value of trading securities as a loss included in net income. Most managers consider such an event outside their control, so they want to avoid this scenario. They have done so by engaging in minimal or no trading activities. You will find only a few examples of non-financial entities with material trading securities listed as assets.

AFS Classification

Many entities purchase equity shares that they don’t intend to trade for short term gains. If they purchase a small percent of the investee’s outstanding shares, less than 20 percent, then the purchasing entity is assumed to have little or no influence over the investee. Like trading securities, the FASB reasoned that fair value is an appropriate method for measuring the asset value. But since management isn’t actively trading the equity shares, market price changes are recorded only in other comprehensive income, not net income. If the shares are eventually sold, then gains and losses recorded in other comprehensive income are reclassified to net income.

As discussed in the “Investment in Bonds” article last week, this accounting gives managers a “slush fund” to increase net income at short notice. All they have to do is sell AFS equity (or bond) securities that have gone up in value and the price gains are reclassified from other comprehensive income to net income. Likewise, if an entity’s earnings from non-investment sources are above expectation, managers might decide to sell AFS securities with losses. It often takes a close reading of an entity’s footnotes to determine whether they have sold AFS securities with gains, and then whether managers did so to reach a net income goal or not. Academic surveys of managers indicate that they do engage in this sort of behavior, although it may not be material to the financial statements except in a few cases.

Equity Method

When an entity purchases a significant percentage of the shares of another entity, they will have influence over that entity. Accounting principles assume that ownership of shares between 20 and 50 percent implies influence over the investee. Influence means that the purchasing entity can influence operational decisions. Examples include influencing whether to expand capacity, raise or lower products prices, outsource operations, engage in research, issue shares or debt, etc. Given influence over operational decisions, the FASB reasoned that also means influence over net income and share price of the investee. Therefore, fair value is an inappropriate accounting approach to record equity method investments in investee equity (because the purchaser influences fair value thus it is no longer fair). The equity method, then, ignores fair value and instead records the investment at initial cost plus the purchasing entity’s share of the investee’s net income (or minus a net loss). For example, if entity A purchases 30 percent of the shares of investee B, then entity A records the cost of its investment as an asset. Then, as time passes, it increases its asset value by 30 percent of investee B’s net income. It also shows its 30 percent share of the investee’s net income on its own income statement. If investee B declares dividends, a further adjustment is made. Equity method accounting is utterly different from fair value accounting, motivated by influence over the investee.

When interpreting equity method investments, the primary roadblock that investors encounter addresses a basic question: How to interpret the meaning of the original cost of an investment plus or minus a percentage share of an investee’s net income or net loss? Many investors will look to footnotes or other information to ascertain a fair value estimate for the equity method investment. Investors should perhaps create their own fair value estimate.

Equity method disclosures are informative, however. If an investee generates high net income, it may signal future good fortune for the purchasing entity. The reason is that many equity method investments are in suppliers, distributors and other entities with similar or related business activities.

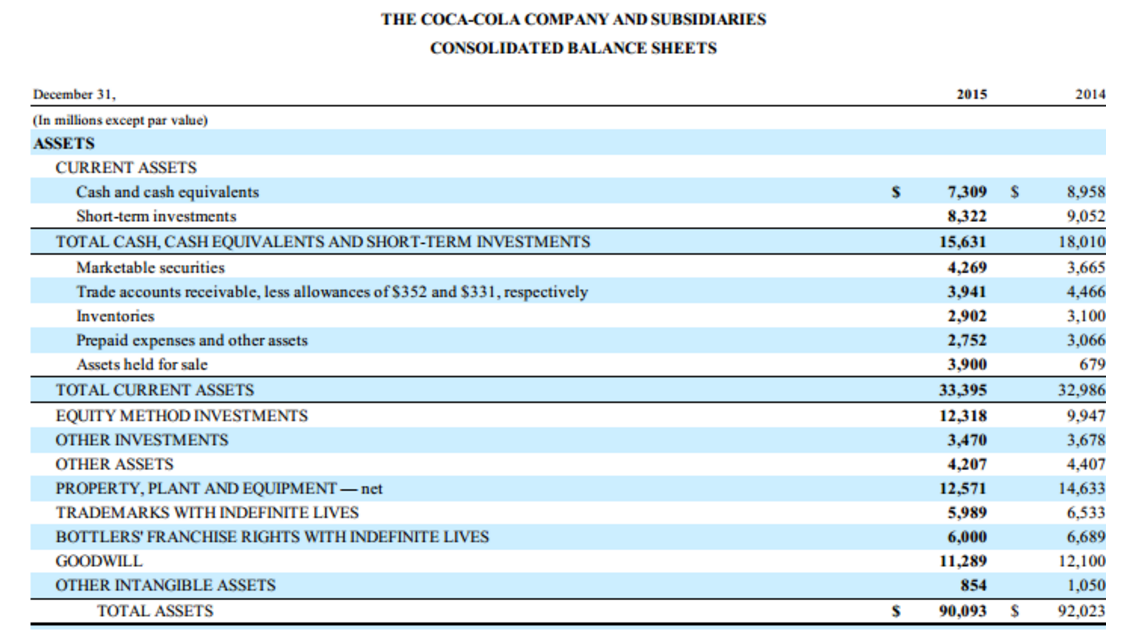

Let’s take a quick look at an equity method illustration.

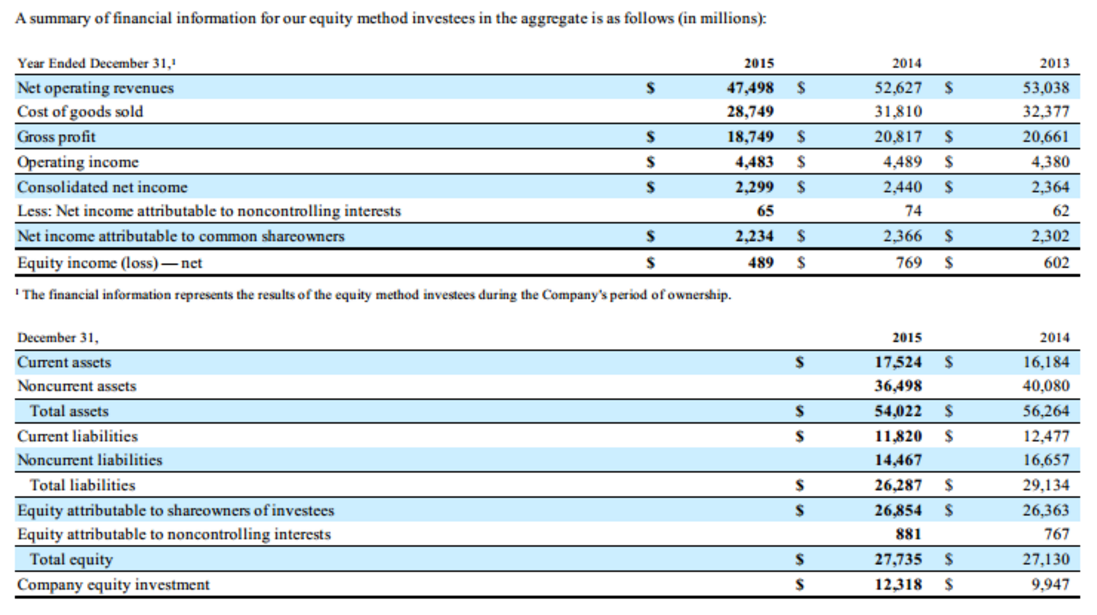

As you can see, Equity Method Investments, at $12,318 million ($12.318 billion), are one of the largest assets for Coca-Cola. The income statement (not shown) records Equity Income of $489 million for 2015. Studying the financial statements, we can learn that the equity investments are in Coca-Cola’s bottlers. The footnotes contain abbreviated financial statements for the bottlers. Here are those financials:

Note that the Net income attributable to common shareowners of $2,234 million in 2015 and the total equity of $27,735 represent values for the bottlers. Coca-Cola owns a percentage of these bottlers, ranging from 17 to 29 percent. For instance, the $489 million of Equity Income recorded by Coca-Cola is 22 percent of bottler’s income of $2,234, and in-line with Coca-Cola’s ownership percentages.