A quick measure of competitiveness

Analyzing gross profit can be a valuable way for investors (and journalists) to better understand how an entity is competing in its industry. An analysis of gross profit can generate penetrating questions that help substantiate or refute managers’ claims of good performance.

The gross profit equation

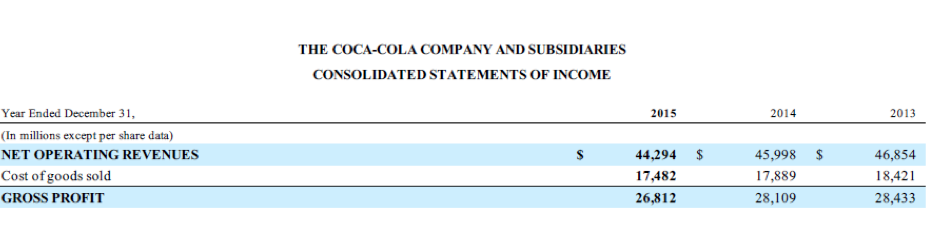

Gross profit is sales revenue less cost of goods sold or less cost of services sold, if an entity sells services. Many entities disclose gross profit on their income statements. Coca-Cola, for instance, includes the following on its income statement:

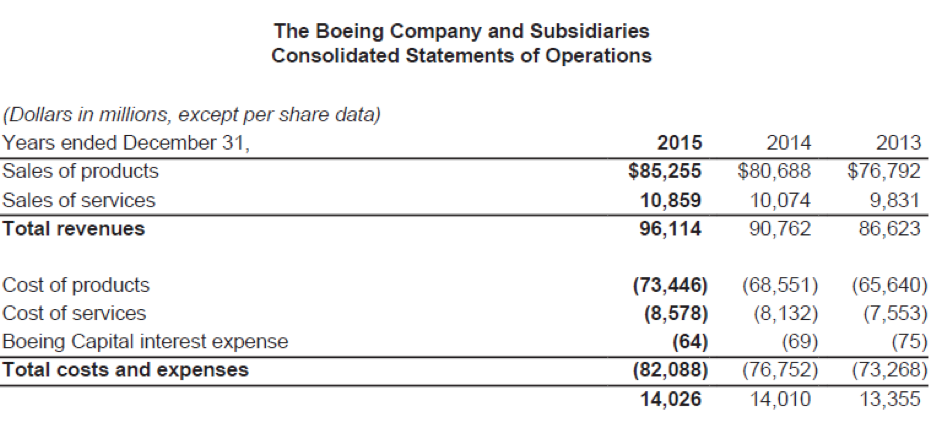

Boeing does not label its gross profit of $14.026 billion for 2015, perhaps because it has two large categories of sales (sales of products and sales of services). Rather than draw attention to the combined gross profit amount, Boeing seems to be signaling that it prefers readers assess the categories separately:

How to analyze gross profit

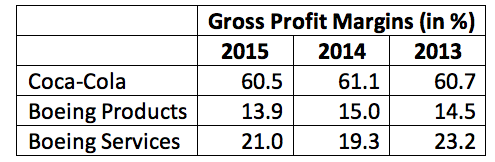

To better assess gross profit, most financial statement analysts will convert gross profit into a percentage as: (GPM). Here are GPMs for Boeing and Coca-Cola:

Analyzing the GPMs, Coca-Cola is often cited as an entity that has built a highly valued brand. Its high, 60+ percent GPMs lend credibility to that view. If you compared Coca-Cola’s GPMs to its competitors, you would expect to see its competitors generating results less than 60 percent. Boeing has struggled to profitably build its new Dreamliner aircraft and we see that its GPMs are low for its product sales. If we compared it to competitor results and entities in other industries, we would find many entities generating substantially higher GPMs. Analysts and Boeing management are both looking for improved GPMs in the near future.

An important—but incomplete—story

Gross profit can signal important clues about an entity’s business. If managers claim to have established an attractive brand (perhaps after incurring large marketing and advertising expenses), they should be able to charge higher prices than competitors, and generate more gross profit. Additionally, some managers claim operations they manage are efficient. If true, then the entities they manage should generate higher GPMs than competitors’ because costs of goods sold or costs of services should be lower for efficiently managed entities.

Overall, gross profit can be telling about profit trends in an industry and whether an entity is capable of competing. But it isn’t a complete story because it doesn’t consider all income statement line items, such as selling, general and administrative expenses or interest expense. It is, however, an important, yet easy to analyze, measure of performance that offers clues about an entity’s competitiveness as well as industry pricing trends.

Reporter’s takeaway

- Analyzing gross profit is often an initial step to understanding how an entity competes in its industry. It also can help substantiate (or refute) managers’ claims of good financial performance.

- Gross profit measures the difference between an entity’s selling prices and cost of goods sold. When gross profit is divided by sales revenue, the resulting percentage, gross profit margin (GPM), is directly comparable to prior year and competitor results.

- Gross profit analysis ignores all other expenses and revenues, gains and losses. It offers a quick but incomplete analysis.

- Gross profit signals the health of an entity’s underlying business. If an entity creates a superior brand and can charge higher prices than competitors, it generates higher gross profit. Likewise, if an entity can purchase or manufacture its goods, or provide services, at a lower cost than competitors, then those efficiencies will translate into higher gross profit margins.