A recent report by the New York Times asserted that more than 1 million consumers are being denied bank accounts because of past problems with overdraft fees and other glitches tallied up by private databases, like ChexSystems, which track consumer banking habits and flag things like bounced checks. The article recounted the stories of people who have been unable to open a bank account — and thus are forced to resort to check-cashing firms and the like, just to do everyday financial transactions — over as little as $40 in overdraft fees.

It’s not a new problem but in light of new scrutiny by the federal Consumer Financial Protection Bureau, and the stats noted by the NYT that as many as 10 million households in the United States may lack access to a basic bank account, I thought it was one well worth localizing. You probably can locate so-called “unbanked” people at check-cashing and cash-advance outlets, or with assistance from credit counseling agencies. Here’s an FDIC report from 2011, the (PDF) “National Survey of Unbanked and Underbanked Households,” that will provide additional context; note the wide variances by region and by state — you can talk with local economists, financial industry officials, state regulators, consumer advocates and counselors about the reasons behind your state’s rate. Also, here’s the sister report from the FDIC on “Banks’ efforts to serve the unbanked and underbanked.” And here’s a Forbes article from January 2013, “Banking the unbanked,” about some initiatives to provide alternatives.

You can also look into initiatives like non-profit community banking. And I would be interested in more on credit unions than was presented in the NYT article; are they as stringent as commercial banks in shunning consumers?

Meanwhile, for an interesting sidebar or personal finance package, ponder all of the other ways consumers can be blacklisted from doing business — or, in other words, why businesses fire thier conumers. A few I thought of offhand:

Insurance.

Whether for delinquent payments, bad accidents or too many property insurance claims, insurance companies may ban patrons; the CLUE database is one method used. Even certain breeds of dogs can botch their owners’ chance of getting property insurance, according to Bankrate. Talk with state regulators and insurers about what sort of activity can get consumers banned, and how insurance buyers can protect their own rights.

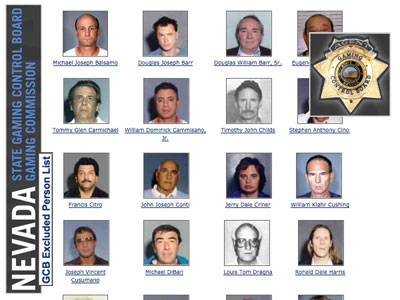

Casinos.

Gambling parlors may ban patrons for activity ranging from cheating to suspected card-counting to wearing Google Glass specs; you might check with your state’s gaming board on trends in banned bettors. And what’s less commonly known is that gambling aficionados may ban themselves; those who worry about their own self-control can ask to be arrested if they set foot on the gaming floor — again, check with officials about statistics and trends. And here’s a new one — Missouri just started allowing people to ban themselves from the state lottery! Obviously no one can prevent them from buying tickets, but they can’t collect winnings if they’re on the voluntary list, and are removed from marketing promos. Interesting.

Retailers.

The Internet is rife with complaints on consumer blogs by consumers banned from venues like Target, Best Buy, Amazon.com and even home shopping titan QVC for returning too high a percentage of their purchases. Retailers tend to shy from talking about any touchy subjects, but you might ask for info about return policies in general and what it would take to get a consumer banned.

Airlines.

We know about no-fly lists, but to what extent to airlines legally blacklist disruptive flyers? Here’s the FAA’s latest list of unruly passenger incidents; I didn’t find info about exclusion rules but you could check with local airlines and offiicals.

Health care.

Here’s an article from Clinical Advisor, a professional journal, on 10 steps health care providers can consider in dismissing problem patients. Here’s a similar article from the American Medical Association. No trend stats seem to be out there, but you could check in with health care providers in your area — what puts patients at risk of being fired by their doctors and other providers?

Think about other occupations and services, from house cleaning to legal services, dog sitting to day care — how do these industries deal with problem clients, and how can consumer avoid repurcussions?