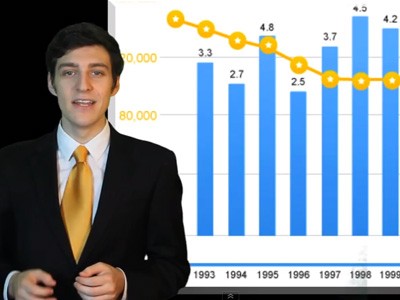

We might take a number like profit margin and look at maybe 100 different variables to figure out which one explains profitability the best, so I can take action on that. But it’s a hard thing to do; you have to know what’s signal and what’s noise.

You know what? There’s no mystery in how to explain profitability. It’s all right there in a company’s financial report. It’s embarrassingly simple.

“For the purpose of the daily news, EBITDA is worthless. Basically, it’s a way to make things look better than they are.”

You take how much the company took in, and subtract what it spent. The number left over is profit (or loss). It’s called “net income” in the reports, but “profit” is the word you’re looking for.*

One “metric” often used is EBITDA, which stands for earnings before interest, taxes, depreciation and amortization. The money people employ this figure to compare one business with another, among other mysterious purposes. For the purpose of the daily news report, though, it’s worthless. Basically, it’s a way to make things look better than they are.

You can’t blame companies for using EBITDA, but that doesn’t mean you have to use it. The financial reports of a company that consistently highlights EBITDA bear close examination, because it just might indicate that things are not quite as good as they seem. EBITDA is “noise” that Frioux presumably wants to eliminate.

The useful Investopedia says: “EBITDA is often used as an accounting gimmick to dress up a company’s earnings. When using this metric, it’s key that investors also focus on other performance measures to make sure the company is not trying to hide something with EBITDA.”

Here’s how Methanex Corp. started its recent press release accompanying its third-quarter financial report: “Methanex Corporation reported Adjusted EBITDA of $184 million and Adjusted net income of $117 million ….”

You have to go pretty deep into the report to learn how much money the company made in the quarter ($101 million.)

All this is just an extension of “say what you mean.” Keep it simple, even if “simple” is brutal.

(You can’t argue with money people about EBITDA. They’ll just say you don’t understand it.)

*Back in olden days, it was Washington Post policy to use the word “profit” instead of “net income.” It was a good policy in that it made the numbers clearer to those readers who don’t regularly read financial reports. That policy has been rescinded, is ignored or is overlooked in the “editing process.”

—

With all the talk of a “grand bargain” on the federal budget, headline writers are dragging out a reliable tool — “Let’s Make a Deal.” Not that it ever disappeared, but we’re seeing more of it lately. Life is not a TV game show. Stop it.

—

Thought that was clever, eh, Ledger of Lakeland, Fla.? Wrong.

—

This is where I usually put something about Bitcoin. This week is no exception, but it’s time for a little levity.