EBIT and EBITDA: Measures of operating performance

EBIT is Earnings Before Interest and Taxes. EBITDA is Earnings Before Interest, Taxes, Depreciation and Amortization. Analysts and managers take these measures from income statements in order to highlight earnings from operations.

Understanding EBIT and EBITDA

EBIT and EBITDA are useful operating performance measures in part because they are more comparable across entities and through time than net income. A key benefit of EBIT is that it excludes interest expense and tax expense to focus directly on operating earnings. Interest expense is a function of how much debt an entity uses to finance its operations, not a function of how operations are performing. Likewise, income taxes are often viewed as more a function of where an entity operates, not how its operations are performing. For example, if you wanted to compare operating performance for two businesses, you might exclude income tax expense because one business operates in France (generally high tax) while the other operates in Singapore (generally low tax).

EBITDA further excludes depreciation and amortization. Depreciation and amortization expense stem from capital investments such as purchasing buildings, equipment or patents. Once capital investments are made, accounting principles assume the assets are in use and wearing out. Depreciation and amortization expense captures the cost of assets wearing out. Excluding depreciation and amortization expense may offer a more focused measure of earnings from operations than EBIT. Many analysts and managers hold this opinion of EBITDA but noted investors, such as Warren Buffett, do not.

Caution interpreting EBIT and EBITDA

Frequently, analysts and managers claim that taxes, interest and particularly depreciation and amortization are not “real” expenses. It is wishful thinking. Taxes and interest are clearly costs of business. Assets do wear out, representing a business cost. Noted investor Warren Buffett isn’t a wishful thinker. In his 2000 Letter to Shareholders, he states, “References to EBITDA make us shudder — does management think the tooth fairy pays for capital expenditures? We’re very suspicious of accounting methodology that is vague or unclear, since too often that means management wishes to hide something.”

As a second warning, EBIT and EBITDA are calculated differently by analysts and managers. As a journalist, keep in mind that these measures can be broadly informative of entities’ financial performances, but some expenses, losses and perhaps gains may be excluded. The excluded items are often referred to as “the bad stuff.” Analysts and particularly managers may bias their calculations of EBIT and EBITDA to portray a more positive future for an entity. Always compare EBIT and EBITDA to the underlying income statement to determine if any expenses and losses are excluded from EBIT and EBITDA.

Example: Calculating EBIT and EBITDA

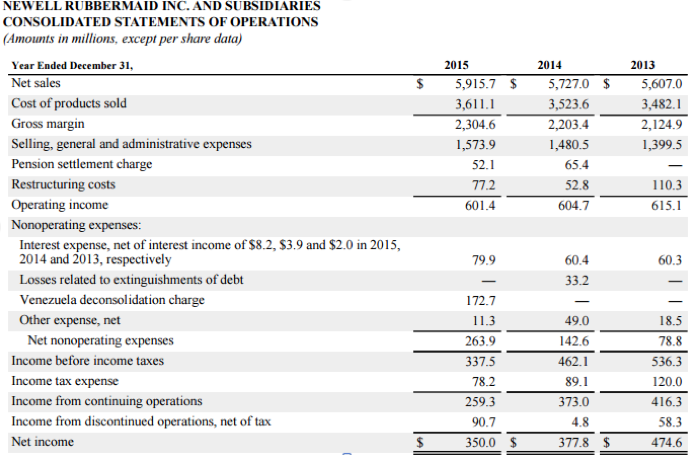

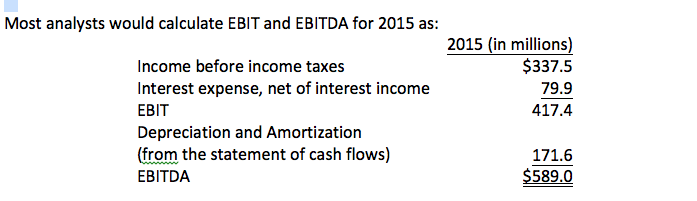

Consider Newell Brands, formerly Newell Rubbermaid Inc:

Refinements can be made to this calculation. Unlike Income before income taxes of $337.5 million, the EBIT and EBITDA results could be compared across years to determine whether Newell’s operations are growing as expected. Wikinvest, as one example, compares EBITDA across competitors. (Note: Wikinvest uses its own procedures to calculate EBIT and EBITDA, leading to results that often differ from others’ calculations.)

Reporter’s Takeaway

• Analyzing EBIT and EBITDA offers a focused view of an entity’s operating performance.

• Interest is added back because it is a function of financing decisions, not operating performance.

• Taxes are added back because they are a function of where an entity operates, not how well it is operating.

• Depreciation and amortization can be added back if viewed as a function of capital investment decisions, not current operating performance.

• Both EBIT and EBITDA are designed to focus on operating performance and therefore exclude some expenses and revenues. Analysts and managers calculate it differently, so you will want to compare EBIT and EBITDA to income statements to assess what has been excluded.