The Wall Street Journal jumped into the murky world of insider trading to see how executives traded their companies’ stock.

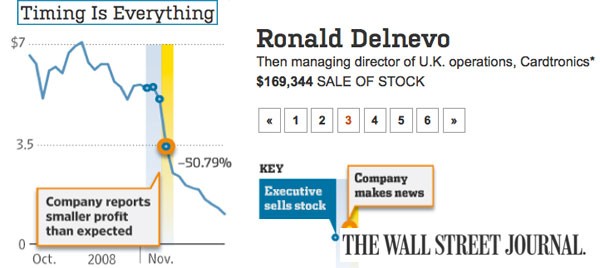

A database they created using information from an eight-year period showed more than 1,000 executives earned big profits or avoided losses when they traded before company news releases.

“It‘s an area that involved an accepted practice,” Susan says. “There are times when you should question accepted practices.”

Michael says the Journal had been reporting about new kinds of insider trading. When one of Susan’s sources told her about an executive who’d sold off many shares right before a news announcement, they had another new angle.

“No good story idea has come without an initial idea from a source on the ground,” Susan says. “It’s not like Facebook. You only need a small number of good sources who can really tell you what’s what.”

The database led to an ongoing series that also has exposed regulatory loopholes that allow executives to circumvent rules designed to prevent improper trading. The work by reporters Susan Pulliam, Rob Barry, and Jean Eaglesham, and editor Michael Siconolfi has earned them this year’s bronze Barlett & Steele Award for Investigative Journalism.

Susan says developing sources is a dying art because of the Internet and because it’s harder for reporters to get inside companies.

To get the story going, Michael paired Susan with Rob, who specializes in analytics. They reviewed executive stock trades to see if news led to the trades, Michael says. “When the data came together, it seemed like we struck gold,” he says.

Susan says working with Rob helped provide a solid foundation and took the story from “good to really good.” It was her first time working with a reporter with computer-assisted reporting skills, she says. “I never again want to work without a [CAR] person by my side.”

The challenge Susan faced was getting information about trading plans from companies, which don’t have to disclose them, Susan said. Many companies tried to ignore or stonewall her requests. Being insistent and persistent sometimes caused the companies to relent, she says.

Sourcing was the key to getting the story started, but the team relationship pushed it forward. Michael and Susan have worked together for more than 10 years. Like many reporters, Susan says having an editor’s support and confidence is like “money in your pocket.”

Michael likens the editor’s role to the coxswain’s in rowing. “You want to guide them and encourage them to make sure the boat moves quickly and smoothly, and make sure to not get in the way,” he says. “The fun part of the process is watching reporters do their thing.”