Lease Accounting is Changing

Recently the Financial Accounting Standards Board approved a new lease accounting standard U.S. public entities will adopt starting in 2019. This shift creates an urgent need to update accounting data systems and procedures because entities’ 2019 annual reports will include comparative numbers for 2018 balance sheets and 2018 and 2017 income statements using the new standard. In other words, while entities prepare financial statements for 2017 and 2018 using current lease accounting they need to prepare to disclose 2017 and 2018 financial statements in 2019 using several (but not all) features of the new lease accounting standard. Let’s use the change in lease accounting as an opportunity to better understand lease accounting as it stands currently. A future article will focus on the new lease standard.

A Few Comments on Leases

Legally, a lease is a contract. The lessee attains the right to use an asset while the lessor provides the right of use. The lessor still owns the asset. The lessee pays the lessor. Economically, leases are popular in part because of their relative efficiency compared to buying an asset. Consider a firm that specializes in leasing photocopiers. Because they specialize, garnering economies of scale and network benefits, they can lease photocopiers at lower costs. If they lease a photocopier to a new business, but the business fails, the leasing company can quickly and inexpensively re-lease the photocopier. If a lessee worries about leasing a photocopier that may become technologically obsolete, a leasing company with many customers may readily agree to exchange any new improved photocopier for the old one because they can readily locate another lessee who can benefit from the older one.

Operating vs. Capital Leases

From an accounting perspective, there are two types of leases: operating and capital. These two types of leases are accounted for differently but before describing the accounting nuances, let’s think about the concept in real-life terms: Suppose the car you lease on vacation for a week hits a series of potholes. Thankfully no visible damage to the car exists. Are you concerned? If you resemble my accounting students, you’re thinking: “No problem–it isn’t my car. I’ll just return it at the end of my vacation.” But now suppose you lease an identical car for five years as your primary vehicle. The day you sign the lease you hit the same series of potholes going the same speed. Are you more concerned? Yes, because now it is “your car” for five years. That’s akin to the difference in operating and capital leases. Legally it isn’t your car because you leased it, but with a five-year lease (which is most of the life of the car with lease payments totaling most of the price of the car) you likely will act as if it is your car. Otherwise it is a rental and you’ll behave as if you don’t own it. If you lease an asset and behave like a renter, operating lease accounting should apply. If you behave like the owner of the leased asset, capital lease accounting should apply.

The accounting reflects this intuition:

- When lessees treat leased assets as if they are owners, they are in essence purchasing an asset and financing it. Capital lease accounting is used. The present value of the lease payments are recorded as an asset and liability on the balance sheet, just as if the leased asset were instead purchased and financed.

- When lessees are in substance renting an asset, operating lease accounting is applied. No asset or liability is recorded (since the leased asset isn’t, in effect, purchased) and instead rental payments are expensed on the income statement as they are owed.

Bright-line Rules for Lease Accounting

To apply the intuition and accounting described above, the FASB implemented bright-line rules. Bright-line rules are clearly defined with no margin for varying interpretations. Simplified, use capital lease accounting if:

- The present value of future lease payments are 90 percent or more of the fair value of the leased asset.

- Or, the lease term is 75 percent or more of the useful life of the leased asset.

Problems with Bright-line Lease Accounting Rules

These bright-line rules have caused problems for financial statement users. Many entities purposefully enter into leases just below the bright-line rules in order to use operating lease accounting (i.e. the lease term is 74 percent of the useful life and the present value of payments is 89 percent). The entity can then use the asset but NOT record it as an asset or record the contractual liability for the lease payments. Instead, only an expense is recorded for any rental payments due. Virtually all investors consider these types of leases as the purchase and financing of assets that are not recorded in the financial statements. That’s a problem.

With no asset or liability recorded, two popular ratios are then miscalculated and potentially misleading. Return on assets (ROA) is overstated because the leased assets are contributing to return but not recorded as assets. At the same time long-term debt to equity (LTDE) is understated because the operating lease payments are not recorded as debt even though there is a legal commitment to pay them.

Disclosure Helps

Most analysts will look to lease footnote disclosures for help with unrecorded, “off balance sheet” operating lease commitments. Public entities are required to disclose future operating and capital lease payments in their footnotes. As described above, the capital lease payments are already recorded as a liability (and asset) on balance sheets. But because operating leases are not, analysts oftentimes estimate the present value of operating leases and adjust an entity’s balance sheet themselves before calculating ratios like ROA and LTDE. Here’s an example:

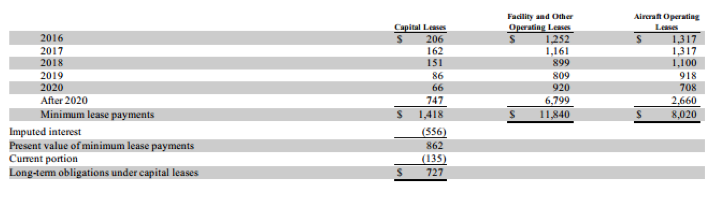

United Continental Holdings, Inc. (UAL) discloses $10.897 billion in debt on its balance sheet at Dec. 31, 2015. Of this, $1.224 billion is current (to be paid within one year) and $9.673 billion is long-term. UAL has another $0.862 billion of capital lease debt on its balance sheet. But then looking at its footnote, reproduced below, UAL has $11.840 billion and $8.020 billion totaling $19.860 billion of unrecorded, off-balance-sheet operating lease commitments (payments) for leased facility and aircraft. With approximately $11 billion of debt recorded on its balance sheet and about $20 billion of unrecorded, off-balance-sheet debt-like commitments, any ROA or LTDE calculations that excluded operating lease commitments will be misleading.

UAL 2015 10-K (annual report) Lease Payment Footnote Disclosure (Note 13) (in $ millions)

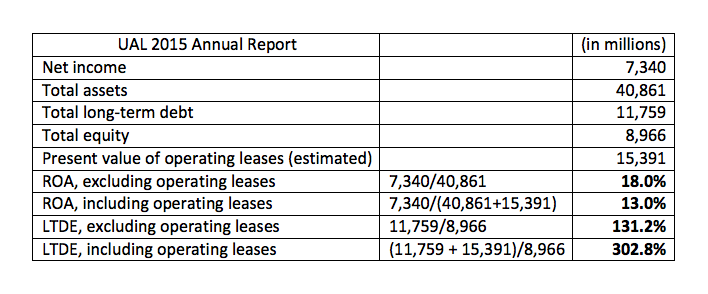

Here are UAL’s ROA and LTDE calculations before and after including its operating lease commitments. To include the operating leases, I have estimated their present value to be approximately $15.391 billion. If you are interested in my estimation, email me. The effects on ROA and LTDE are:

Adjusting the balance sheet and income statement to include operating leases materially worsens ROA by 5 percent and doubles the LTDE. UAL earns a much lower return and carries far more debt than its balance sheet and income statement disclose.

The New FASB Lease Standard

The new lease standard is (very) complicated and the subject of a future article. One of the main features is that lessees will recognize a “right of use” asset and lease liability for nearly all leases, including operating leases. This is the biggest change in the new standard and may address the issues highlighted previously.

Business reporters could potentially pursue lots of business journal articles. Consider the following:

- Will the new standard help financial statement users incorporate operating leases into their analyses?

- Will entities shift to longer-term lease contracts because there is no longer incentive to engage in shorter-term off-balance-sheet operating leases?

- How will debt contracts be rewritten to accommodate the lease accounting change?

- Will the market react to operating leases differently once their effects are recorded on the balance sheet?

- Which entities will experience large or small changes in their balance sheets?

- What discount rates will entities use to calculate present values?

- How will estimates of the present value of operating leases compare with entities’ recorded amounts?

- Do these accounting changes impact the leasing industry and if so, how?