Now that W-2s and other documents are arriving in mailboxes, there’s ample opportunity for business journalists to find story angles around filing taxes. Here are three sources of information that will get you started.

State taxes: changes year-to-year and state-to-state

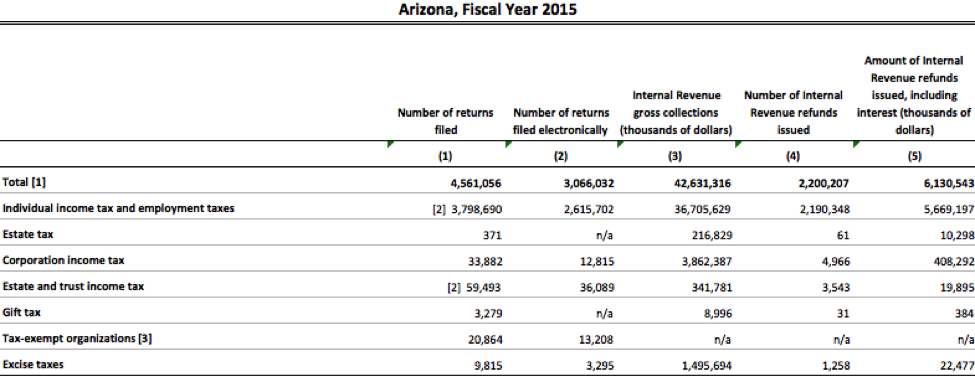

The IRS provides a database of state tax statistics that includes figures on tax returns, the amount of tax collected and refunds. Tax statistics tables from 2008 to 2015 are now on IRS.gov. These enable business journalists to draw comparisons of tax revenue not only by state but also by year. For example: Arizona’s 2015 internal revenue collection was $42 billion, up $2 billion over 2014. For comparison, that’s a little more than one tenth of the state tax revenue that California collected.

In addition, the IRS organizes government websites by state, listing state tax departments as well as other important government sites related to business and commerce.

The IRS Data Book

The Data Book from the IRS is another useful resource for tax season stories. It is published annually and organizes data into sections. The first section provides data on filed returns, collected tax and issued refunds, which is organized by the type of tax and by state. For example, paid tax preparers filed nearly 78.1 million tax returns compared to 3 million returns filed by taxpayers using IRS programming, according to the 2015 Data Book.

Sections 2,3 and 4 focus on law enforcement and how the IRS audits returns, deals with tax-exempt activities and secures unpaid tax returns using penalties and criminal prosecutions. Fox Business used statistics from the 2015 IRS Data Book to give readers tips on how to avoid being audited when filing their tax returns.

Other sections offer a wide variety of data as well. Section 5 provides information on assistance programs the IRS uses to help taxpayers. Section 6 focuses on issues related to governance of tax-exempt activities. Section 7 gives an overview of IRS Chief Counsel’s workload and activities in terms of legal matters and section 8 elaborates on IRS’s budget activities.

Business journalists can download full version in .pdf format or access individual tables as Excel files.

Accounting firms

Tax season is often the busiest stretch of the year for accountants. According to U.S. News, one in five accountants works more than 40 hours a week. Investopedia’s reporting shows tax season entails even longer working hours and creates more stress. A profile documenting a day in the life of an accountant can give your audience an inside perspective. Business Insider’s story on a partner at a Big 4 accounting firm provides a comprehensive approach to this sort of story, but reporters can find equally compelling storylines in smaller, local firms, including new tools these accounting agencies use to improve efficiency and drive revenue. For background, reporters can turn to CPA Practice Advisor, a resource for tax and accounting professionals. It recently reported how cloud computing is transforming an accountant’s role in small business by shifting focus from manual workflows to data analysis.

Reporter’s Takeaway

• Use the IRS database of tax statistics to draw comparisons of tax revenue by state and by year.

• Include fresh data and charts contained in IRS Data Book to give a bigger picture of your story.

• Consider a profile on a typical day of a busy accountant during the tax season, as well as new trends in accounting firms