Black Friday and Cyber Monday are a heartbeat away, and the signs are positive for the retail sector. The National Retail Federation forecasts that this year’s U.S. holiday sales (not counting cars, gas and restaurants) will increase between 3.6 and 4 percent, totaling between $678.75 and $682 billion. Here’s a look at several new angles to consider as you cover holiday shopping.

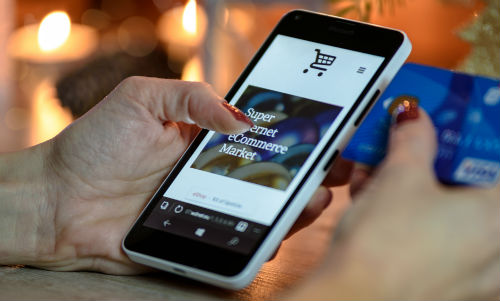

Mobile shoppers face credit card risks

Mobile shopping has been a major driver in Cyber Monday sales and holiday sales in general, and this holiday shopping season is likely to continue that trend. Facebook IQ offers this snapshot of the U.S. mobile-first customer: 61 percent are male and nearly 60 percent are 18-34 years old. However, experts caution that fake mobile shopping apps could put consumers’ personal information and credit card details at risk. How can readers know they’re downloading the official retailer app? Consider asking online shopping experts or cybersecurity firms—or even local university professors who teach information technology—to compile a list of red flags.

Shippers deal with delivery challenges

Three-quarters of shoppers plan to take advantage of free shipping offers, according to a just released Deloitte report. With online shopping getting bigger each holiday season, major retailers like Walmart and Target are attempting to compete with Amazon. However, package theft (packages stolen from mailboxes and doorsteps) poses a frustrating wrinkle for online shoppers and retailers.

For a local angle, talk to law enforcement about any trends they’re seeing and their tips for preventing package theft (for instance, in-store pick-up, which brick-and-mortar retailers are promoting. You might also talk to local apartment complexes about how they handle package delivery for residents. Many have complex processes in place but not all are happy with this extra burden. Just in time for the holiday shopping season, Amazon has announced a new program called Amazon Key that allows couriers to deliver packages inside the homes of Prime members. Are locals embracing this development or do they have security concerns?

Meanwhile, FedEx is imposing holiday shipping surcharges in certain situations. Will this impact any retailers operating in your area? Will they eat the cost, pass it onto their customers or do they plan to ship via other means?

Retailers get creative with incentives

Some smaller, independent retailers must get creative to compete with Amazon and other retail titans, so look at the more unusual events and promotions they’re running. One example: men’s panic parties, which cater to last-minute male shoppers purchasing holiday gifts for their wives or girlfriends. Some of these events even feature free beer, pizza and gift wrapping. Are any local retailers hosting men’s panic parties? Or do they have other promotions up their sleeves?