Business reporters can get up to speed on market indexes with a backgrounder on the Dow and S&PIn my first Financial Market Reporting piece, I complained that many reporters make casual reference to “the market” without specifying what they mean. Usually, I wrote, they mean the Dow Jones Industrial Average, which I called the “best known” stock market measure. The DJIA is just one of a multitude of stock market indexes that pop up in virtually every discussion of the markets, including reports evaluating individual stocks and other investment vehicles. So they warrant a closer look.

The first index

The DJIA was not the first stock market index. It was not even the first index created by Charles Dow. In 1880 Dow, who was 29 years old, moved to New York and got a job at the Kieman Wall Street Financial News Bureau, which furnished financial news to banks and brokerages. In those days there was a lot of “fake” news, designed to tout companies and their stocks. But the Kieman service had a reputation for sticking to the facts.

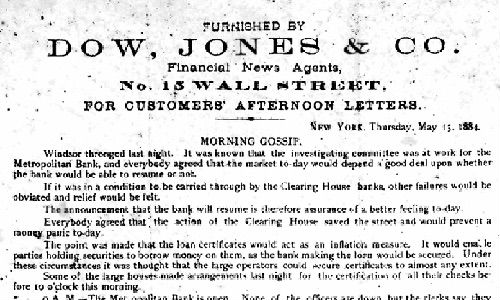

Dow figured if one responsible news service could succeed there was room for more, and with a fellow reporter, Edward Jones, founded Dow, Jones & Company. The pair produced newsletters and summaries of financial news, which they delivered to financial institutions and investors. Their “Customer’s Afternoon Letter” quickly grew to have more than 1,000 subscribers.

Dow saw the value to his readers of a single number that could capture a day’s trading activity and be an easy way to identify market trends. From that insight, in 1884, the Dow Jones Average was born. Dow selected what he saw as the most important companies of the day. There is some disparity among the historical records but it appears the first index included nine or 10 railroads, one steamship line and the telegraph company Western Union.

Computing the index

Dow simply added up the closing stock price of each of the companies, and then divided by the number of companies, reporting the average or mean. Today we call this a price-weighted index. This means stocks with higher share prices have a greater weight in the index.

Mergers and acquisitions, bankruptcies, stock splits and changes in the fortunes of the companies in the index have required adjustments in the membership of this elite club over time. To compensate for the changes so that numeric comparisons can still be made, an adjustment factor (called a divisor) is calculated and applied to the average. Today, the divisor is less than one, making it a “multiplier”.

Other changes were made as Dow’s own fortunes advanced. With financing from a third partner, Charles Bergstresser, Dow expanded the “Letter” into a full-fledged newspaper, rebranded The Wall Street Journal. Bergstresser wasn’t interested in putting his name on the company, even as Dow Jones grew into a business news giant. It remained under the control of the partners and their heirs and successors until it was sold to Rupert Murdoch’s News Corp in 2007.

The Dow Jones Index grew to 20 stocks and was renamed the Dow Jones Transportation Average. In the public eye, it was replaced by an index of 30 stocks, the Dow Jones Industrial Average. A third index, the Dow Jones Utilities Average, has 15 members.

Index competition

The Dow indexes are not without competition, most notably from Standard & Poor’s, which in 1923 created what it called the “Composite Index,” tracking a small number of stocks. In 1926, the index expanded to 90 stocks and in 1957 it grew to cover 500 companies.

The S&P 500, unlike the Dow, is a value-weighted index. That means it is based not on the stock price but on the market capitalization (stock price times number of shares outstanding) of 500 of the world’s largest companies. While the Dow feels the impact of all price movements equally, the S&P 500 will respond with a large movement to even a small price shift of a large company.

As the availability of computing power increased, so too seemed the desire for indexes that track even larger numbers of components. The NYSE and NASDAQ Composites include every stock on their respective exchange. And there are indexes that use more complex weighting methods, such as fundamentally based indexes. These try to incorporate economic fundamental factors to better reflect corporate valuations. For general reporting purposes we tend to stick with the Dow and the S&P 500.

The indexes have triggered the creation of a new set of investment vehicles, and new investment strategies of interest to the public. I’ll look at some of those in my next post.

Reporter’s takeaway

• Dow’s first index, dating to 1884, was what we now call a price-weighted index. The closing stock price of each company is added up, then divided by the number of companies.

• Standard & Poor’s “Composite Index,” introduced in 1923, is based on market capitalization (stock price times the number of shares outstanding) of 500 of the world’s largest companies.

• A price-weighted index is most influenced by companies with high share prices.

• A value-weighted index is most influenced by companies with high market capitalization.

In his longtime role as New York Bureau Chief and Senior Correspondent for public television’s Nightly Business Report, Scott Gurvey covered the financial markets, business and the economy for the first and longest-running daily program dedicated to financial news on broadcast television. Currently Gurvey writes for various online sites, teaches the next generation of journalists and advises companies and nonprofits on media relations, communications strategy, ethics, newsroom operations and online application design and practice. His blog, “Public Offering,” lives at http://blog.scottgurvey.com, and Gurvey has been known to Tweet at @scottgurvey, from time to time.