Blue Apron, Ipsy, Dollar Shave Club, Book of the Month, Stitch Fix, BarkBox: What do they all have in common?

They’re part of the rising trend of subscription boxes, delivered faithfully within a certain time frame, often on a monthly basis. Food, alcohol, clothing, beauty products, fitness, health, toys, pet accessories, fan-related content, and more — sometimes, pitted against each other in the same category, such as the eternal battle between HelloFresh and Blue Apron.

In the past 12 months, Google Trends saw a particular uptick in searches for “subscription boxes” during the holiday season, mostly in December. Overall, interest has been growing in the past five years, starting primarily in 2016 and has been rising ever since.

This business trend is maturing, according to a 2018 study by Hitwise, which provides insight into online market trends. Hitwise reports that 18.5 million Americans visited at least one subscription site last year, a 24 percent increase since 2017. Much of the consumers include mostly women and late-Millennials and Gen X’s, according to Forbes. The majority of subscription box revenue comes from food or beauty-related boxes.

Here are a few ways to unpack this trend.

The basics of subscription boxes

There’s a variety of subscription boxes out there. Which are at the top? (Here’s a compilation of those out there, including a “most popular” from USA Today for 2018.) What partnerships do they have? How do they advertise to customers and keep them coming back?

Is the original start-up owner (or owners) still running the show, or have they been bought out, such as Unilever acquiring the Dollar Shave Club? How are their profit margins? Do they differ over time, or have stayed the same?

Do people subscribe to multiple subscription box services? Forbes found out that 15 percent of online shoppers sign up for more than one on a continuing basis. Many are on a monthly basis.

And lastly, who do they reach?

Subscription boxes serving an underrepresented need

At times, the mainstream market isn’t enough, causing frustration among those affected by the lack of market quality or quantity.

Some subscription box companies are trying to change that.

An example would be plus-size clothing. Despite that the average American woman wears clothing that’s size 16 and above, there is a lack of plus-sized representation or clothing in the fashion industry. Some companies advertise body positivity, yet don’t carry clothing beyond a size 12, while others do sell plus-size clothing that is overpriced or ill-fitting.

Subscription models such as Dia & Co. specifically cater to those who find the market lacking, offering personal stylists, surveys of personal preference, and opportunities to try out different styles.

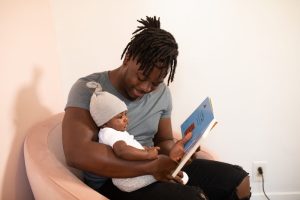

British subscription box company TreasureTress advertises to the hair care market of black women in a similar fashion, matching customers with products tailored to their age, routine and more.

Although the black hair care industry is valued at more than $2.5 billion, U.S. companies are lacking —as is society in general. Natural hair is considered “unprofessional” or “messy,” causing people in politics, Hollywood, schools, and more to speak out against the favoring of “traditional” hairstyles. Dreadlocks, for example, were banned in the U.S. Navy until recently last year.

Mental health is also a rising concern, and some companies are creating “self-care” boxes in response to those who suffer from anxiety. A few carry more to a tailored therapy market, such as college students or kids with autism.

What kind of products are in subscription boxes?

Nowadays, people like to know what exactly they’re putting in (or on) their bodies. Food subscription boxes, like Blue Apron and Hello Fresh, tout the suppliers of their ingredients, as well as their policies on using GMOs, cruelty-free meat, quality and more. Even sold on its own, ugly fruit finds a home, as such services like Imperfect Produce boast that they “source produce directly from farms.”

This extends, of course, to other suppliers of clothing and more as well. Do the companies source locally? Are they made in the U.S. or overseas? What are the labor conditions and standards there? How are the workers treated? What about the manufacturing and transportation?

Are they also selling in stores? BuzzFeed expanded their Tasty products to supermarkets and big box stores, such as Walmart. Are any of the subscription boxes doing the same? (Birchbox, for example, is selling at Walgreens.) What additional revenue does that bring the companies? Are people more prone to buy them in-store or as a monthly-delivered package?