How subscription design makes it easy for students to lose track of their money.

Why do $10 monthly subscriptions seem small when their total cost is not? That is the question at the center of the micropayment economy, better known as the subscription model. Netflix. Spotify. Apple Music. Quizlet. Grammarly. Canva. Uber One. The gym, the car wash, the cloud. Individually, they take five dollars here, ten there, or “$9.99” if you prefer the marketing-friendly charm. Together, they add up to rent money.

Mia Romero, a sophomore at Arizona State University, scrolled through her phone, reviewing a list of subscriptions: Apple Music, Amazon Prime, Netflix and a car wash membership. Then she paused.

“Canva was one that slipped under my radar,” she said.

The design app had been charging her $20 a month, even though she hadn’t used it in weeks. “I thought I didn’t have to pay for it,” Romero said.

Her case demonstrates a broader trend. According to C+R Research in 2022, consumers estimated they spent an average of $86 a month on subscriptions, but actual itemized totals averaged $219. For students, these charges can add up, both financially and psychologically, reinforcing behaviors such as loss aversion and the sunk-cost fallacy.

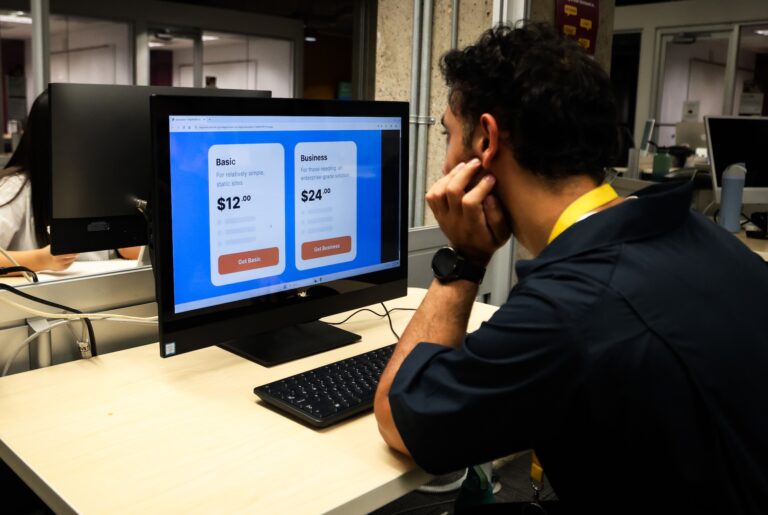

“Subscriptions are set up as a low upfront cost,” said Frank Jee, clinical associate professor of marketing at Arizona State University’s W. P. Carey School of Business. “People are not able to see what that means in terms of a year, or if it ends up being a perpetuity, how much value it adds up to being.”

Why do we keep paying?

The psychology behind the subscription model is intentional. Companies rely on consumer biases that make it easy to forget or avoid canceling. Jee points to loss aversion: canceling feels like giving up something that already belongs to you.

“There’s a loss aversion component to it, where it feels like a much bigger loss to lose benefits we used to have with Apple Music, my playlist, my personalized choices, and all that tends to be a huge loss,” he said.

Another bias is the sunk-cost fallacy. After paying for several months, people continue subscribing to justify the expense. Music on the way to class, streaming before bed and late-night food delivery, until students begin to see optional services as necessities.

To keep spending habits in place, companies use the anchoring effect, the practice of setting prices just below a round number. Jee said consumers often remember the first figure they see, not the final total with fees. “If it says $19.99, that’s what sticks, even if fees and taxes push it higher.” Reading from left to right reinforces the illusion. A $3.99 item feels closer to $3 than $4, and a $9.99 subscription seems cheaper than $10, even though the charge is the same.

Social pressure also plays a role. Students often subscribe because friends share playlists, stream the same shows or split group accounts. Opting out can feel like being left out.

Companies take advantage of that dynamic, said Jee. “There’s a fear of missing out, or FOMO, and also a fear of better options, or FOBO,” he said. “Subscription services use that to their advantage. If you don’t take a rate now, you may not have access to it later.”

Why is canceling so hard?

Signing up for a subscription can take seconds. Canceling one can stretch into weeks.

Romero said she tried to stop a recurring charge but kept getting bounced between apps, customer service lines and emails.

“I called customer service, and they told me to do it through the app. I tried the app, but it didn’t work, so I had to go back to customer service,” she said. “They gave me an email, and after a week of back-and-forth, I finally asked my bank to block the transactions.”

In October 2024, the Federal Trade Commission finalized its “click-to-cancel” rule, requiring companies to make canceling a subscription as simple as signing up. But in July 2025, the U.S. Court of Appeals for the 8th Circuit struck down the rule on procedural grounds, citing flaws in the FTC’s economic impact analysis and rulemaking process.

“The tangibility of money impacts spending,” said W.P. Carey’s Jee. “If subscriptions were paid in cash, it would feel very different.” Behavioral economists call this the “pain of paying,” the discomfort people feel when they physically hand over money. But when payment is separated from the moment of use, that pain fades. Spending becomes easier, and subscriptions slip into the background.

What would it take to break the cycle?

Solutions are possible, but they require both systemic and personal change. Regulations like click-to-cancel could protect consumers from trapping users in endless cancellation loops, but financial literacy is equally urgent. Jee said that students must start with the basics: track expenses in a spreadsheet, compare revenue with costs, and ensure subscriptions do not exceed 5% of a monthly budget.

The question, then, is not whether students can afford $4.99 for Apple Music. It is whether they can afford the psychology of forgetting: the normalization of money leaking out invisibly, the habit of tolerating small losses, the resignation that ten dollars “doesn’t matter.”

“It becomes part of a routine,” Jee said.