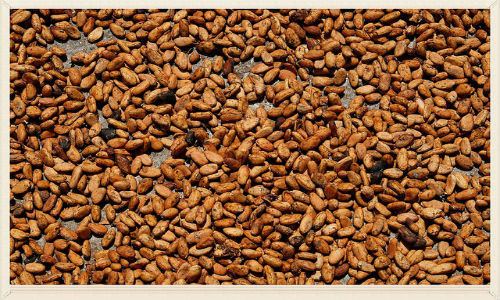

Products like wheat, coffee, cocoa, cotton, milk, sugar, orange juice, live cattle and even pork bellies are bought and sold on more than 50 major commodity markets worldwide. Generally, agricultural products and goods that are farmed are dubbed soft commodities, while natural resources that are mined–including oil, copper, gold, silver and rubber–are called hard commodities.

Understanding futures contracts

Futures contracts are the oldest and remain the most common way to invest in commodities. A futures contract is an agreement to buy or sell a commodity at a fixed price but to be delivered and paid for on a specific date down the road. Many large institutional investors invest in commodity markets, as do producers and hedgers. Producers and users of the raw goods often use commodity markets to take a position to reduce the risk of financial loss due to rapid price changes. For instance, airlines will often buy oil futures to mitigate the risk of huge spikes in the price of oil. Commodity markets tend to be very volatile compared to traditional stocks. Many investors close out commodity positions before the contract “comes due” and never actually take delivery of the underlying commodity.

Marry commodities and companies

The best way for local reporters to write about commodities is to think about how their prices will affect the profitability of local companies. As a general rule of thumb, higher commodity prices tend to boost profit for companies producing the commodities, while increasing expenses for firms using commodities as raw material. A local coffee shop may be hit hard when the prices of coffee spike. But a local corn farmer or cotton grower may reap huge profits when the prices of those goods increase. While growers will likely benefit, higher cotton prices can be hard on clothing manufacturers, including jean makers, that rely on cotton to manufacture their products. A local chocolate shop can be hard hit when the price of cocoa spikes, and so forth.

While many regions of the U.S. don’t have oil producers, many industries are affected by oil prices. Trucking companies, airlines and shippers like FedEx and UPS are likely to see a boost from lower oil prices. Auto makers and tourism-related companies are also likely to benefit.

Follow weather patterns and geopolitical events

The prices of commodities tend to rise and fall based on supply and demand. Drought or adverse weather conditions for particular crops can cause the prices of commodities to spike. For instance, cotton needs a lot of sun and heat, but if it rains when the cotton bolls are starting to open, that can damage the product. Similarly, cocoa, which is primarily grown in West Africa, can be affected by crop diseases and geopolitical conflict.

Political unrest in oil-producing countries can also affect global oil supply and drive up prices.

Sourcing

Reporters looking for local stories can track supply reports, economic reports, regulatory changes, supplier actions, weather and seasonal patterns to report on commodities. Local businesses that rely heavily on commodities are also great sources, along with traders, investors and economists.

“Cocoa beans” by Flickr user Tom Hart on Creative Commons (CC By SA 2.0)